Trunnion Trends

With strong roots solving manufacturing issues in Europe, rotary transfer machine technology is finding justification solving similar issues in North America. It’s still not for everybody, but increasingly, with technological advances in capability and flexibility, it may make more sense for shops on this side of the pond.

If there were a single method for manufacturing metal workpieces, I’d be out of a job, and your shop’s process development and capital investment strategies would be greatly simplified. The one “all singing, all dancing machine tool” that makes everything has yet to come to the market. Ours is still an application-specific industry with a variety of potential solutions available.

There is a tendency to consider technologies that are “new”—laser machining comes to mind. However, there are also many established metalcutting machine designs that suddenly make sense because the parameters that were once used to justify them have changed. It’s the old expression, “What’s old is new again.”

Featured Content

In this article, we will look at one of those “older” technologies and explore some manufacturing trends that may make it “new” again for your shop’s production needs. Specifically, we’ll look at trunnion-type rotary transfer machine tool technology.

Standalone Stampede

Historically, transfer technology represented the ultimate volume production processing technology. Lot sizes in the millions and jobs that ran for years were the norm, and dedicated or hard-production automation made sense. It still does if one can find the work.

However, the kind of work available for traditional high-volume transfer technology changed. Lot sizes have come down, shorter product life cycles have led to more frequent engineering changes and much of the really high-volume “bread and butter” parts have been shipped to lower-cost producers overseas and south of the border.

The dedicated nature of previously available transfer technology simply doesn’t allow shops to cost-effectively respond to these changes. Hard automation got a black eye.

Under the banner of flexibility, shops looked elsewhere for technology that could do the job of machining castings, forgings and other machining applications in volumes and mixes that were reflective of the changed reality. For many, that took the form of CNC lathes and machining centers. Linking these capable machines into cellular production centers using automated material handing systems, gantries and pallets allowed shops to deal with more complex part geometries. In addition, the cells could be easily reconfigured to accommodate variances in lot sizes and part design changes.

For barstock material applications, the multi-spindle screw was and is still viable technology for high-volume production of turned parts. However, shops using the traditional cam-actuated machines faced the same problem as the transfer machine shops—limited operational flexibility often requiring secondary machining operations on more complex parts and time-consuming change-overs.

Installing CNC machining centers for secondary operations along with the production strategies of scheduling part families across a setup has helped many of these shops cope with the flexibility issues. However, new issues that go beyond flexibility, including labor cost competitiveness and availability, challenge high-volume production of prismatic parts, rotational parts or a combination of both, and may again open the door for rotary transfer consideration.

Round And Round

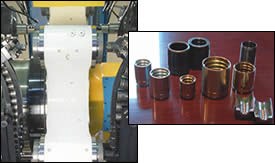

Rotary transfer, like the name implies, moves parts from tool station to tool station in a circular path. In a trunnion machine, its plane of motion resembles a Ferris wheel.

The word “trunnion” suggests the direction of the rotary transfer. Literally, a trunnion is a pin on which a cannon pivots up and down. In a trunnion machine tool, the trunnion is the horizontal shaft around which the parts are indexed.

The circumference of the workholding disk varies with the number of stations it carries. Because the cutting tools are simultaneously engaged with the part at each station around the periphery of the trunnion, each index drops a complete part. The number of tools available also varies by machine size.

To find out about what’s new with rotary transfer technology, especially trunnion-type production machines, I spoke with Mike Hoff, the product manager for Italian machine builder BTB North America (products are distributed by Gosiger Import). Mike sets the stage for rotary transfer this way: The bottom line for manufacturers in North America and Europe is finding ways to be competitive with manufacturers that can produce at significantly lower costs.

Europe has already dealt with its set of challenges, including high social costs in the form of wages and mandated benefits as well as regulated working hours. Newer CNC-equipped, flexible rotary transfer machine technology has been a good solution for many of these shops trying to keep manufacturing domestic.

Mike also says some of these European-specific challenges and others have migrated to North America. Rethinking how technology is justified in light of some of these challenges makes Mike bullish on trunnion machine resurgence in the North American high-volume production market.

Transitioning

Historically, trunnions earned their keep primarily with machining forgings, castings and cut blanks. This created a chasm of sorts between bar-fed (screw-machine) production houses and rotary transfer shops.

What we’re seeing now, says Mike, as a response to increased material costs, is a trend toward hot- and cold-formed blanks as well as near-net shaped castings across the chasm. The advantage is less material waste, lower tooling costs because metal removal is reduced, and there is a significant reduction in the floor space requirement.

Another European trend away from bar material, Mike notes, is the tendency for bar-fed machines to run the entire bar lot on a single setup. This can result in the necessity of holding finished inventory. Cut bar or other chucked material allows the shop to run only the cycles necessary for the order and eliminate the cost of holding finished inventory. This savings, as well as the material costs, is causing Europe to consider alternatives to barstock.

A flexible CNC trunnion machine can be tooled to produce parts complete, eliminating the need for secondary operations and the attendant machine tools, tooling and necessary labor. These newer machines not only axially machine both ends of the workpiece, but can be configured with vertical tools and angular spindles to radially attack the workpiece, accomplishing five-sided machining.

An example of this transition, Mike cites, is a customer that over a 6-year period went from 100 multi-spindle screw machines to ten in favor of 31 rotary transfer machines. By implementing rotary transfer, the shop was able to double its business with half the machine tools and one-third of the labor. “We’re seeing growth in the kinds of applications that now make production sense for rotary transfer,” Mike says.

Another justification metric that BTB is applying to rotary transfer technology is revenue per square foot. Long a gage for success in retail businesses, revenue per square foot is becoming a barometer for manufacturing as well, Mike says. In the case of the screw machine shop mentioned above, its revenue per square foot and its revenue per employee shot up. Moreover, the additional floor space can be allocated for future capacity growth.

Current CNC rotary transfer machines can produce parts simultaneously and complete while using a much smaller footprint. The trunnion is a tall machine, but it is not wide. Plus, it generally doesn’t use a bar feeder, which further reduces its floor space requirements. It’s an advantage if a shop can avoid or postpone adding to its plant while still being able put more machines in the same floor space.

Shops that have transitioned to BTB rotary transfer technology, on average, have installed six to seven machines. In general, one rotary transfer will equal the production output of ten multi-spindles in one-tenth the floor space and with a tooling cost reduction of two-thirds, Mike says.

Who Should Consider Trunnions?

According to Mike, “The customer base for BTB’s rotary transfer technology is broad. Virtually any shop engaged in high-volume parts production in most industries is a candidate for this level of technology.

“But for the most part, they all have some entrepreneurial culture within the organization,” he continues. “Most customers we have had success with are defiant about losing work to other producers and to growing their manufacturing niche. Looking forward, they see rotary transfer as a technological differentiator to help accomplish these goals. In general, they are looking for a better way.”

For most of these shops, it doesn’t make sense to invest significant capital in technology that virtually any other shop can easily implement. “That’s one reason we’re seeing more interest in rotary transfer processing in North America,” Mike says. “It’s not a drop-in solution.”

Rotary transfer technology is a highly engineered, application-focused production system. It’s as far from a commodity as one can get, which increasingly is the appeal.

For years, a million parts was the ante to consider rotary transfer technology. Today, with the incorporation of vision systems on the front end and back side, material handling technologies of various stripes, in-process measurement and even in-process parts washing, the minimum entry level has lowered. Mike pegs the number at 200,000 today.

With most applications being run as families, he further separates the overall part run of 200,000 into minimum lot sizes of 5,000. The dimensionally closer parts in a family are, the shorter the change-over is from lot to lot.

These systems are literally factories unto themselves. In general, the engineering goal is for bulk material to enter the system and finished goods to exit. In some cases, even preliminary assembly work is engineered as part of the work flow. All of this takes place automatically.

At an average of more than $1 million per unit, implementing rotary transfer takes a strong commitment from a business and selectivity from BTB. The application and solution have to be right.

“We are seeing about one-half of our customers choosing to run these machines 24/7 or 8,000-plus hours per year,” Mike explains. “This has a significant and meaningful impact to their return on investment, and these machining systems can run around the clock because of their weight and mass. As an example, a machining system that is running at 400 parts per hour means 3 million parts per year with an 8,400-hour year compared to 2.2 million parts for a 6,000-hour year. At this rate for an $8 part, that is $6,400,000 more billing per year.”

BTB finds that 50 percent of its machine sales are to existing rotary transfer customers for increasing capacity. The next 25 percent is upgrading existing customer’s machines and the last 25 percent is new shops looking to produce a different way than they have in the past.

Trunnion machines are not the mythical “all singing, all dancing” machine tool. However, with the integration capability that Gosiger’s Engineered Systems Division can bring to the right application by engineering flexible production of parts families 24/7 and with the auxiliary post-process capabilities available, they are getting closer.