Is a ‘Side Hustle’ on Your Horizon?

By: Derek Korn

I’ve written about machine shops that have created a separate business for fun, as a complement to their existing operation or as a means to leverage their manufacturing prowess. Here’s a bit about a few of them.

#columns

The Value of Mass Finishing, Shot Blasting for Aerospace and Medical Applications

By: Colin Spellacy

The choice between mass finishing and shot blasting for CNC-machined parts depends on the specific requirements of the application.

#techbrief

The Value of CMM Controller Retrofits

Edited by Derek Korn

In this case, new controllers for two coordinate measuring machines — one 26 years old — with new programming software offers the possibility to enable multisensor inspection of critical, turned aerospace components.

#techbrief

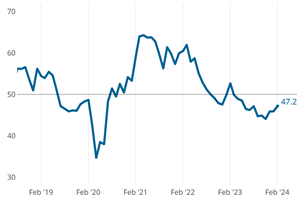

Gardner Business Index: Precision Machining February 2024

By: Jan Schafer

Precision Machining activity contracted a little slower in February, resuming its path inching toward flat.

Job Shop Discovers and Fills a Fishing Need

Edited by Derek Korn

The promise of a product line for improved mounting of electronic fish finders led this Missouri job shop to an automated turning process.

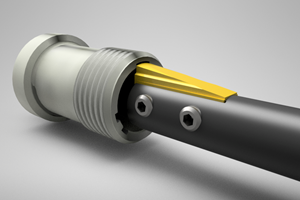

Broaching Tool Technology For Lathes Used to Slot Inconel Parts

Edited by Derek Korn

This shop finds value in using an indexable-insert-style broaching tool to create blind-hole slots in heat-treated Inconel aerospace parts on a CNC lathe.

How Well do You Know Granite Surface Plates?

Edited by Derek Korn

Here are some tips for choosing, maintaining and customizing a granite solution that will best meet your shop’s particular inspection needs.

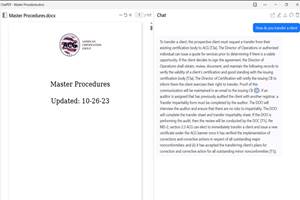

AI and Your QMS Procedures

By: Joel Pecoraro, Director of Operations, American Certification Group

Will artificial intelligence soon impact your quality system operating procedures? It could.

#columns

Production Machining's Most-Viewed February Articles

By: Cara Ready

February presented a wide range of captivating topics for the Production Machining audience. Take a look at our top 10 most-viewed articles from February based on Google Analytics.

A Tale About an Automation Solution Discovered in Production Machining

By: Derek Korn

A CNC Swiss production supervisor took to LinkedIn to describe how he discovered a rotary parts collector in the pages of our publication and has since purchased and benefited from it.

#columns

Consider This Another CMMC Reminder

By: Derek Korn

Machine shops serving the military/defense industry that currently aren’t working toward achieving Cybersecurity Maturity Model Certification could be caught flat-footed once it’s required.

Tool Path Improves Chip Management for Swiss-Type Lathes

This simple change to a Swiss-type turning machine’s tool path can dramatically improve its ability to manage chips.

Top Shops 2024 Is Now Live

By: MMS Editorial Staff

The Top Shops 2024 survey for the metalworking market is now live, alongside a new homepage collecting the stories of past Honorees.

Manufacturing Madness: Know When to Speed Up and When to Slow Down

By: Matthew Kirchner

Knowing which to do when can make the difference between world-class leadership and average management.

#columns

Opening Up to Possibilities

By: Jim King

As a business leader, are you wasting time defining barriers when you should be defining the possibilities instead?

#columns

Precision Machining Technology Review: February 2024

Edited by Chris Pasion

Production Machining’s February 2024 technology showcase includes some of the latest technology from Index Corp., Edge Technologies, Kyzen, SMW Autoblok and more.

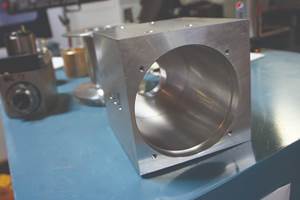

When a “Boxy” Part is Machined on a Lathe

Edited by Derek Korn

South Morgan Technologies has long thrived on its ability to mill prismatic parts on a turning platform. Today, newer technology and techniques enable saying “yes” to that work than ever before.

#horizontal-and-vertical-lathes

The Value of RFID Machine Operator Authentication

Edited by Derek Korn

Can secure shopfloor employee authentication via radio frequency identification enable shops to optimize their data-driven manufacturing efforts?

#Industry40

Addressing Micro-Boring Challenges

By: Derek Korn

This boring bar/tool holding system for Swiss-type lathes is said to offer high rigidity and positioning repeatability. In addition, the boring bars can be changed out using no hand tools.

#techbrief #micromachining

Production Machining's February 2024 News Highlights

Edited by Chris Pasion

Production Machining’s February 2024 news highlights include new facilities and expansions, partnerships, anniversaries and more.