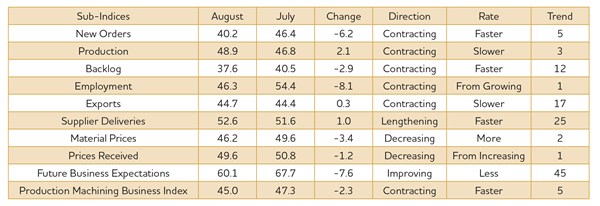

August Reflects Fifth Month of Contraction

Material prices decreased for the second month in a row.

With a reading of 45.0, the Gardner Business Index showed that the production machining industry contracted for the fifth month in a row and at its fastest rate in almost 2 years. Other than a sharp upward spike in the first quarter, the index has generally trended down since January last year.

New orders have followed a similar pattern to the total index. The new orders index has generally fallen since January last year except for a sharp spike up in the first quarter of this year. New orders have contracted at an accelerating rate for 5 straight months. In August, new orders contracted at their fastest rate since December 2012. While production has contracted for 3 months in a row, the rate of contraction decelerated in each of those months. The relative strength of production compared with new orders has sent the backlog index further into contraction. The backlog index has contracted since September last year. In August, the backlog index contracted at its fastest rate since September 2013. The backlog index indicates that capacity utilization will trend lower heading into 2016. The employment index fell sharply from the previous month, contracting for only the second time since December 2013. Exports continued to contract because of the strong dollar. The rate of contraction was about average for the last year. Supplier deliveries lengthened somewhat in August. The rate of lengthening has picked up in the previous 3 months, but was still below the rate of lengthening from January 2014 to March this year.

Material prices decreased for the second month in a row, and the rate of decrease accelerated in August. The material prices index has fallen steadily since it reached its peak in June last year. Prices received by screw machine shops were virtually flat in August. While prices received have contracted in 3 of the last 5 months, the index has trended up very slightly during those 5 months. After jumping in July, future business expectations fell back down in August. They were still slightly above the level of expectations in June, which was the lowest point for the expectations index since December 2012. Expectations were below average for the third time in 4 months.

In August, the smaller companies contracted for the fourth consecutive month while the larger companies contracted for the fifth time in 6 months.

In August, the only region to grow was the Southeast. It has grown 3 of the previous 4 months, and it has been the best performing region in each of those 4 months. The West contracted for the fourth time in 5 months. Contracting at a similar rate in August, the North Central-West contracted for the fourth month in a row. The Northeast contracted for the third time in 5 months. The North Central-East contracted for the third time in 4 months, and its index was the lowest since the survey began in December 2011. The index for the South Central has been below 40.0 every month but two since December last year.

.JPG;width=70;height=70;mode=crop)