Gardner Business Index for Precision Machining: April 2016 - 43.5

The Southeast region grew in three out of the first four months this year.

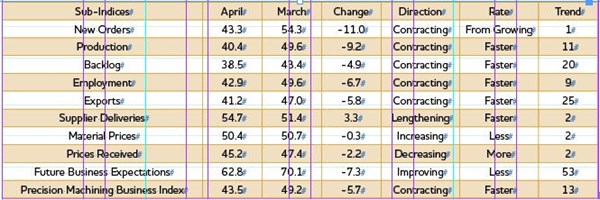

With a reading of 43.5, the Gardner Business Index showed that the precision machining industry contracted for the 13th month in a row. While the index had improved significantly since November, in April the index showed that the industry contracted at virtually its fastest rate this year.

New orders contracted after increasing in March. The index fell back to its level in February. Production contracted for the 11th month in a row, contracting at its fastest rate in 2016. The backlog index contracted for the 20th consecutive month, contracting at a somewhat faster rate than the previous two months. Employment contracted at its second fastest rate since the index began in December 2011. Exports contracted at their fastest rate since the survey began. Supplier deliveries lengthened for the second month in a row, lengthening at their fastest rate since March last year.

Material prices increased for the second straight month. However, the increase was minimal and well below the rate of increase in material prices from 2013 through the first half of 2015. Prices received at machine shops decreased at an accelerating rate for the second consecutive month. The rate of decrease was virtually the fastest in the history of the survey. Future business expectations dropped since March, but remained significantly above the level seen for most of 2015.

Facilities with more than 250 employees contracted for the second time in three months. In April, they contracted at the fastest rate of all plant sizes. Plants with 100-249 employees contracted for the third month in a row, but the rate of contraction has decelerated each month. Companies with 50-99 employees expanded for the second straight month. Companies with 20-49 employees contracted once again after a single month of growth in March. Shops with fewer than 20 employees continued to contract, with the rate of contraction the fastest since December.

For the fourth month in a row, the Southeast region was the strongest region. It was the only region to grow in three of those four months. And, in April, its index was 59.3, which was the region’s fastest rate of growth since the survey began. From the slowest to fastest contraction, the other regions were the Northeast, North Central-West, North Central-East, West, and South Central. Both the West and South Central had an index below 40.

Future capital spending plans reached their highest level since November last year. Compared with one year ago, they increased 2.8 percent, which was the first month they increased since November 2014. The one-month rate of change has improved significantly in recent months, indicating that the industry could be on the verge of the next upturn in capital spending.

.JPG;width=70;height=70;mode=crop)