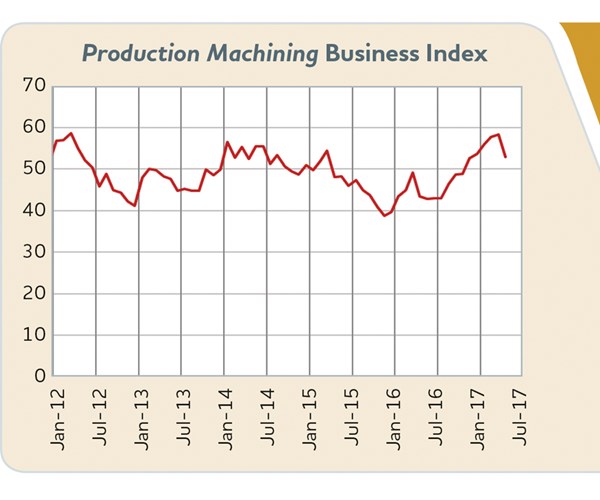

Gardner Business Index: Precision Machining, April 2017, 52.9

April had the fastest rate of growth that the precision machining index has had since March 2015.

With a reading of 52.9, the Gardner Business Index showed that the precision machining index grew for the sixth straight month. However, the rate of growth slowed sharply to its slowest rate since November 2016. But, other than the current streak of growth, April was still the fastest rate of growth since March 2015.

New orders grew for the seventh month in a row, the rate of growth decelerated to its slowest rate since October 2016. Production grew for the eight month in a row, but it too decelerated noticeably. April was its slowest rate of growth this year. The backlog index increased for the fifth straight month. This was a strong indication that capacity utilization will increase in 2017. Employment increased for the fifth month in a row, although the rate of growth decelerated for the second month in a row. Exports contracted at an accelerating rate for the second consecutive month. Supplier deliveries continued to lengthen, but they did so at a slower rate in April.

Material prices increased at a slightly faster rate in April. April’s index was the second highest since the survey began in December 2011, moving above 70.0 for only the second time. Prices received increased at a strong rate for the fifth month in a row. The rate of increase was relatively constant during those five months. While future business expectations remained strong, the index fell sharply to its lowest level since October 2016.

While every region had an index of at least 54.0 last month, in April only two regions had an index above 54.0 and one region contracted. The North Central-East was the fastest growing region. It has grown for six straight months and five of those months had an index above 54.0. The South Central had strong growth for the sixth straight month. The North Central-West, West, and Northeast also grew. The Southeast contracted as its index fell to 42.3 from 57.4

Facilities with more than 250 employees grew for the fourth time in five months. Plants with 100-249 employees grew for the fifth time in six months. The index was above 63 each of the previous three months. Plants with 50-99 employees increased for the fifth month in a row. Shops with 20-49 employees grew for the fourth month in a row, but the rate of growth decelerated the previous two months. Shops with fewer than 20 employees contracted after growing the previous five months.

For more manufacturing economics news, visit Steve's blog.

.JPG;width=70;height=70;mode=crop)