PMBI Shows Three Straight Months of Growth

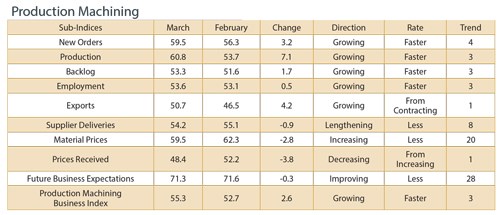

With a reading of 55.3, Gardner’s precision machining index showed that business conditions expanded for the third month in a row in March.

With a reading of 55.3, Gardner’s precision machining index showed that business conditions expanded for the third month in a row in March. The rate of growth increased from last month, but was slightly slower than it was in January. Industry conditions have improved steadily and significantly since last September. This month the index was 11.0 percent higher than it was 1 year ago. This is the sixth month in a row that the month-over-month rate of change grew. The annual rate of change has grown at an accelerating rate the last 2 months.

New orders increased for the fourth straight month and the fifth time in 6 months. Production expanded for the fifth time in 6 months, reaching its fastest rate of expansion since March 2012. Since the index began in December 2011, there have been only 3 months with a faster rate of growth in production. Backlogs increased for the third straight month. Backlogs have been increasing at a tremendous rate compared with 1 year ago, which indicates that capacity utilization and capital spending should be increasing significantly during the remainder of the year. Employment grew for the third straight month. Exports increased for the first time in the history of the index. Supplier deliveries continued to lengthen, but they have done so at a slightly slower rate the last 2 months.

Material prices continued to increase, but the rate of increase was less than the last 2 months. After four straight months of accelerating increases, prices received contracted. Future business expectations are still quite strong, but they have cooled off somewhat the last 2 months.

Shops with more than 50 employees continued to expand at a rate similar to that of the first 2 months of the year. Shops with 20-49 employees increased at their fastest rate since March 2012. On average, facilities with more than 20 employees had an index of roughly 58.0 in March. However, facilities with fewer than 19 employees contracted for the second month in a row, although the rate of contraction was relatively minor. These small facilities have only grown 1 month since April 2012.

The Pacific region grew at the fastest rate in March. It grew for the fourth time in 5 months. Its rate of growth in March was the fastest any region has recorded in the history of the index. It was followed by the East North Central region, which grew for the third month in a row, and the South Atlantic region, which grew for the fifth time in 6 months. The Middle Atlantic region contracted slightly for the second month in a row, and the West North Central region contracted for just the second time in 6 months.

Planned capital expenditures were 19.3 percent lower than what they were 1 year ago. This is the thrid straight month that the month-over-month rate of change contracted. The annual rate of change has contracted at a faster rate each of the last 3 months.

.JPG;width=70;height=70;mode=crop)