Little Change in Business Conditions

Supplier deliveries made the biggest improvement in August, moving to lengthening from shortening.

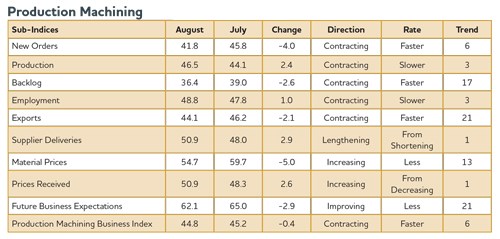

With a reading of 44.8, Gardner’s precision machining index showed that business activity contracted for the sixth straight month in August. For the last 3 months, the index has hovered around 45.0, which indicates the industry has contracted at a fairly constant rate.

Half of the sub-indices were better than reported in July, while the other half where worse. Supplier deliveries made the biggest improvement in August, moving to lengthening from shortening. This indicates some momentum to increased activity in the industry. Production gained almost as much, but it contracted for the third month in a row. Also, employment contributed to a higher index, although it contracted for the third consecutive month. Exports have contracted since the start of the survey. The rate of contraction has been fairly constant. Backlogs have contracted for 17 consecutive months. The rate of contraction has increased at a noticeable rate since February. New orders were the most significant drag on the overall index in August. They contracted at their fastest rate since December 2012 and have been on a downward trend since March.

Material prices are increasing, but at the slowest rate yet this year. Prices received increased in August after decreasing in July. That means prices received have increased every month but one this year. However, the rate of increase is much lower for prices received than material prices. Future business expectations fell slightly in August, but have been at a fairly consistent level since February.

Every region contracted in August, which is the first time that has happened. The slowest rate of contraction was in the Middle Atlantic. Its rate of contraction was much slower than the previous 2 months. It was followed by the East North Central and Pacific, both of which saw a slower rate of contraction in August. The South Atlantic and West North Central contracted significantly after expanding in previous months.

Planned capital expenditures hit their highest level since February. They are about 10 percent above the historical average. However, the month-over-month rate of change has contracted 5 of the last 6 months.

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=970;quality=90)