Job Candidate Questions and What They Tell Us

By: Matthew Kirchner

Individuals who ask thoughtful, original questions in the interview set themselves apart.

#columns #workforcedevelopment

Shop and School Symbiosis

By: Carli Kistler-Miller

PMPA member Clippard Instrument Laboratory has been working with Butler Tech for over 45 years and the benefits keep growing.

#pmpa

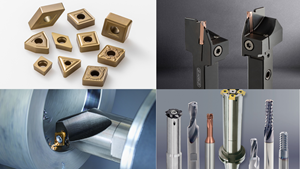

Precision Machining Technology Review: April 2024

Edited by Chris Pasion

Production Machining’s April 2024 technology showcase includes some of the latest technology from Sumitomo Electric Carbide Inc., Horn USA Inc., Seco Tools, Tungaloy, Edge Technologies, The L.S. Starrett Co., Emuge-Franken USA and more.

Automated High-Production Welding of EV Rotor Shafts

Edited by Derek Korn

This cell is able to perform joining, preheating and welding operations for rotor shafts used in electric vehicles.

#techbrief

Standard Control Functions with Swiss-Types in Mind

Edited by Derek Korn

Features in this line of machine-specific CNCs assist setups, offer synchronized movement commands and provide other standard, not optional, capabilities to streamline Swiss-type programming.

#techbrief

4 Bright Ideas for Effective Lights-Out Machining

By: Contributed By Simon Richardson, Anca

Adopting lights-out machining involves considerations when a machine shop decides to move forward with the process. Here are some tips to a successful implementation.

#techbrief

Production Machining's April 2024 News Highlights

Edited by Chris Pasion

Production Machining’s April 2024 news highlights include new company leadership, strategic partnerships, cybersecurity initiatives and more.

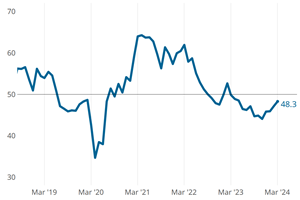

Gardner Business Index: Precision Machining March 2024

By: Jan Schafer

Precision Machining activity in March looks similar to February, with contraction slowing while staying on its path toward flat.

When to Use a Diaphragm Chuck

By: Derek Korn

The accuracy and repeatability of these chucks make them well suited for a number of workholding applications, including turning and grinding.

#techbrief

My Journey to an Accidental Career that Became My Passion

By: David Wynn

“Machining was not the career I chose; it chose me.”

#pmpa

Recognizing Signs of a Degrading Workplace Culture

By: Manoj Mohta

Is your machine shop missing key “culture elements?” Here are ways to identify if your organization is heading in the right or wrong direction in terms of establishing a healthy company culture.

#columns #workforcedevelopment

Production Machining's Most-Viewed March Articles

By: Cara Ready

From the integration of Artificial Intelligence (AI) into machining processes to the intricacies of CNC lathes, our coverage in March delved into a diverse array of topics crucial to the precision machining industry.

Inside the Premium Machine Shop Making Fasteners

By: Evan Doran

AMPG can’t help but take risks — its management doesn’t know how to run machines. But these risks have enabled it to become a runaway success in its market.

Buy a Solution, Not a Machine

INDEX collaborates with customers to find a total solution to meet their needs.

Piezoelectric Sensor Technology: Moving Toward more Efficient Machine Monitoring

Edited by Derek Korn

A new system that uses simple and compact force or strain sensors, which can be integrated inside toolholders or mounted on surfaces such as spindle housings, can facilitate CNC machine monitoring.

#Industry40

Last Chance to Register for PMPA’s National Technical Conference

By: Derek Korn

The Precision Machined Products Association’s NTC will be held in Cincinnati, Ohio, April 28-30. Learn more about how you can benefit from “collaborating for a better future.”

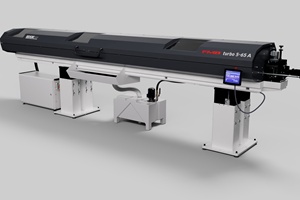

The Value of Auto Adjust Magazine Bar Feeders

By: Kevin Meehan, President, Edge Technologies

This bar feeder is designed to offer the flexibility to enable CNC turning centers to perform short-run work that would otherwise require frequent setups over a range of barstock diameters.

#techbrief

Implementation and Tracking: Strategic Planning | Part 2

By: Carli Kistler-Miller

A strategic plan that you have to dust off does not advance your business.

#pmpa

Precision Machining Technology Review: March 2024

Edited by Chris Pasion

Production Machining’s March 2024 technology showcase includes some of the latest technology from Unisig Deep Hole Gundrilling Systems, Kyocera Precision Tools, Swiss Steel USA Inc. and more.

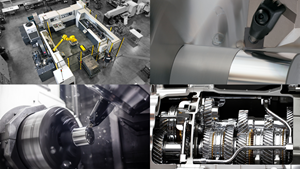

Inverting Turning and Five-Axis Milling at Famar

By: Evan Doran

Automation is only the tip of the iceberg for Famar, which also provides multitasking options for its vertical lathes and horizontal five-axis machine tools.