Aerospace and Automotive Continue to Provide Growth and Opportunity

Appears in Print as: '2019 End Market Special Report'

This year has been one of transition for manufacturing. But research from Gardner Intelligence indicates that some markets, such as automotive and aerospace, are showing positive signs for 2020.

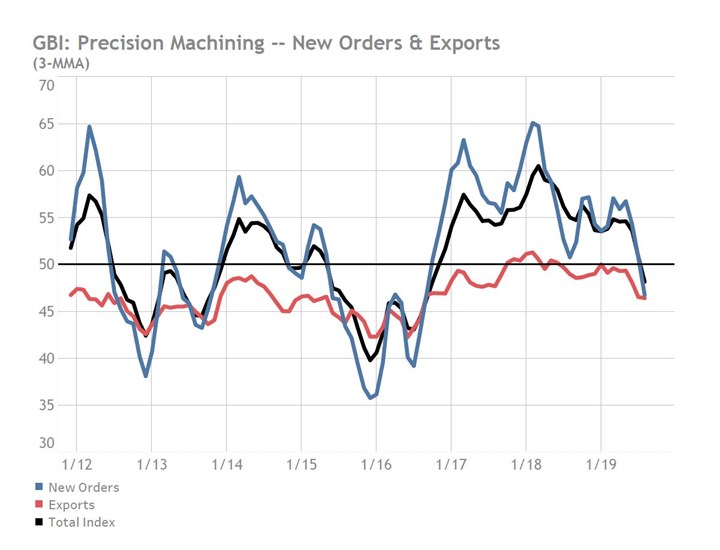

In Production Machining’s 2018 End Market Special Report we stressed to our readers the importance of supply chain management, and as our team traveled the country during 2019 the significance of this advice was clear. This past year has been one of transition for production machinists and for the manufacturing sector as a whole. Near the start of the year, strong domestic new orders more than offset contracting export orders according to our survey of production machinists; however, by July, machinists were reporting contracting activity in both domestic and export orders, according to Gardner’s Snapshot Business Index tool. Static to slightly decreasing demand for the construction of new homes, weak crop prices and sagging new vehicle sales have all contributed to weakening business activity levels in the manufacturing sector.

The above chart represents three-month moving averages of the Precision Machining Index and two of its six components. Recent months of individual readings have witnessed total demand contract faster than exports.

Automotive

Beyond the near-term pain of a looming economic slowdown that may restrain the automotive credit markets, manufacturers have reasons to be positive about the industry in the long run. The demographic profile of the country will see the millennial generation create vast opportunities for the country in the coming years. Data from 2019 shows that millennials between 22 and 37 years old out-earned all prior generations in the last 50 years on an age and inflation-adjusted basis, according to the Pew Research Center. The data claim this is largely a result of more dual-income families and of women being paid more competitively than in past generations. Furthermore, Pew has estimated that the population of millennials surpassed that of the baby boomers sometime during 2019.

Featured Content

The implications of these factors indicate two important points that should be considered by the automotive industry, which ranks second in consuming the largest amount of an American individual’s lifetime earnings (behind only lifetime expenditures on housing). The first is that with a more reliance on dual incomes to support a family’s basic needs, families will continue to support the long-enduring, multiple-car ownership trend, especially outside of metropolitan areas where transportation alternatives are limited. Despite the growth of new transportation options including Uber, Lyft and their competitors since at least 2010, the number of registered vehicles per household continues to climb.

Second, based only upon birth year, one half of all millennials will reach the age of 40 and, thus, the start of their peak earnings, by 2028. While these macro factors will not have much impact on the market in the immediate future, millennials can be expected to have their own unique set and prioritization of vehicle preferences. This will compel OEMs to invent new features starting in the next few years that meet these unique preferences and drive new capital spending on research and development and consequentially new investments in capital goods.

The auto industry is the largest end markets impacting production machinists. This industry’s near-term growth prospects will be constrained by a myriad of challenges in 2020 with few near-term factors to support higher vehicle consumption. In the years following the Great Recession, low financing rates on new vehicle loans coupled with longer loan durations drove down monthly payments and bolstered sales. The boost provided by these factors, which was first felt several years ago, has since faded. Previously cheap credit and lax lending standards by banks are being undone by tightening lending standards as the volume of past-due and defaulted auto loans has risen.

Aerospace

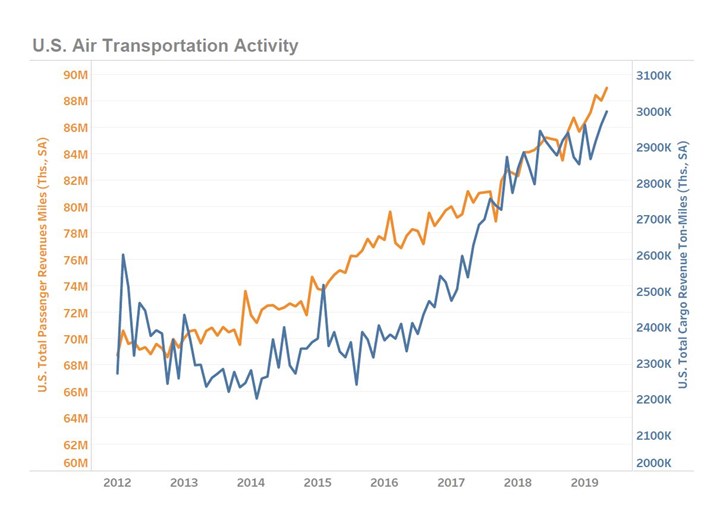

The aerospace market is expected to rebound in 2020 after facing specific challenges in 2019. Demand for aerospace services in both the passenger and freight segments has been unceasing since the Great Recession. Wall Street’s 2020 revenue growth expectation for the aerospace industry, at almost 11%, will make the industry one of the fastest growing during what is expected to be an underwhelming year for the overall U.S. economy (expected growth rate of only 2%). The revenue rebound from Boeing will be significant, with 2020 expected revenues of almost $122 billion compared with 2019 estimates of close to $86 billion.

Developments in extraterrestrial transportation for both commercial and military sectors adds yet more potential to the aerospace industry’s growth potential. The development and recent deployment of unmanned aerial vehicles (UAVs), hypersonic weapons and advanced missiles by a multitude of governments has raised the potential for a more dangerous future. Such systems, along with the growing importance that satellites play in civilian and military activity, has resulted in outer space becoming a highly valuable and, thus, militarily strategic arena. The result is that several nations in recent years have developed and tested weapons systems against satellites with the purpose of being able to deny foes the use of space for reconnaissance, communication and GPS navigation.

All of this activity has resulted in an unprecedented amount of demand for manufactured products in the aerospace industry. Based upon the limited financial data of U.S. publicly listed rocket and space-oriented firms, the outlook for these firms appears to be particularly positive. Wall Street’s 2020 and 2021 projections for such firms places both their revenue and earnings growth in the double-digit range. It is unclear what portion of this growth is from commercial and military activity. Regardless, manufacturers serving the supply chains of such OEMs should find increasing near-term opportunities for growth.

Although some leading indicators of the economy suggests a slowdown, demand for aerospace services as recently as the first-half of 2019 continues to grow well above the rate of overall economic growth for the United States. (source: U.S. Bureau of Transportation Statistics: U.S. Air Carrier Traffic Statistics)

Gardner’s Business Index (GBI) data provides hard-to-find insights to the manufacturing business activity.

About the Author

Michael Guckes

Michael Guckes is chief economist at Gardner Intelligence, the research and market intelligence division of Gardner Business Media. He provides forecasting, modeling and consulting services to clients and provides content for all Gardner brands. For more information about Gardner’s Business Index, visit gardnerintelligence.com.

.jpg;width=70;height=70;mode=crop)