Benefits of Renting or Leasing an Industrial Robot

Appears in Print as: 'Robot Rental and Leasing Considerations'

Choosing a robot rental or leasing plan might be a wise business decision compared with purchasing a robot outright.

#techbrief

RobotWorx reconditions robots as a primary business model for all major brands. The company cleans and repaints robots and robotic systems, but also refurbishes by doing a complete overhaul, replacing nonconforming components. The warranty comes with the exact same one-year parts and labor warranty that is offered when purchasing new. Photo credits: RobotWorx

Whether your shop is considering dabbling in robots for the first time or robot automation has already been introduced on your shop floor, choosing a robot rental or leasing plan might be a wise business decision compared with buying one outright at a higher cost.

According to Tom Fischer, operations manager at RobotWorx, rental programs are a good option for those shops that are interested in using the robot for six months or less, while leasing programs are advantageous for shops that are familiar with robot automation and hope to save cash, finance 100% of the purchase, have affordable monthly payments and have the ability to easily upgrade a robot purchase to the latest technology.

Featured Content

RobotWorx sells, rents and leases new and reconditioned industrial robots, work cells and spare parts. Although it is not a financial firm, it recommends finding a reputable one to work with to keep your company free of surprise charges and fees.

When Renting Makes Sense

For a company that is considering investing in a robot for the first time, it can be a big step that requires an understanding of the type of automation necessary for an application in order to make a sensible purchase – one that isn’t overcomplicated or too costly. In this case, renting a robot might be the best solution. According to Fischer, robot rentals are well-suited for people who want to understand automation prior to investing in it.

“Once you are at five or six months of rental, it’s no longer in the customer’s favor to continue renting.” — Tom Fischer

“Learning what a robot can do for you helps you make that decision of whether to move forward with an investment,” Fischer says.

But renting a robot can also be beneficial for high-volume, short-run production; research and development; proof of concepts; and staff training.

Rental programs are based on weekly or monthly payments for the short term. “Once you are at five or six months of rental, it’s no longer in the customer’s favor to continue renting,” Fischer explains. “You’re looking at purchasing or leasing at this point to get the most value out of the system.” If a shop decides to keep the robot at that time, RobotWorx offers a 20% rental price that can be credited toward the purchase of that robot, he adds.

RobotWorx automation experts can visit a shop to help with robot integration. The company’s rentals also come with a limited warranty for any repairs.

When Leasing Makes Sense

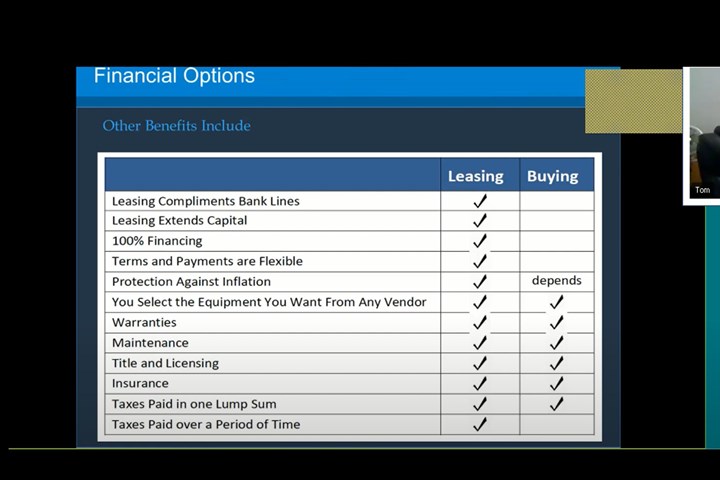

Leasing, a lesser known option for purchasing equipment, is not necessarily better than buying equipment with cash or traditional financing. However, it might be financially beneficial to some companies that would like to save cash, preserve business credit and have access to ongoing equipment updates, according to Fischer.

One major benefit to leasing that many people enjoy is financing 100% of a purchase, which includes delivery, installation, training and taxes, he explains. “Also, it is much easier to get financing for leasing than it is a typical loan. It’s basically the evaluation of your creditworthiness and credit history, and then working through it with the finance company,” he adds.

The benefits of leasing a robot can far outweigh the benefits of buying a robot.

Leasing also offers minimum cash outlays, flexible terms and options, and aggressive rates. Equipment financing saves working capital and capital that would be used for paying cash for your equipment. “With an equipment lease program designed around your budget and needs, you make affordable monthly payments over time,” Fischer explains. “This allows you to save your cash for operations, expansion, unforeseen events and more.”

He also points out that equipment leasing enables a company to keep its business credit line open while strengthening its cash position. Lease financing also protects the shop from inflation because leasing costs remain the same throughout the life of the original leasing agreement.

Beyond the financial benefits of leasing is having a firm grasp on life cycle management. Depending on the type of business you run, equipment leasing can help a shop stay on top of the latest advances in equipment and technology. “Being able to make upgrades to newer equipment when your short-term lease is up gives your company a competitive edge,” Fischer says. He adds that the alternative (buying equipment) usually binds a shop to that equipment unless it can be sold before costly repairs come into play or prior to becoming obsolete.

For more information about the types of lease and rental programs available from RobotWorx, visit robots.com.

RELATED CONTENT

-

Automating CNC Lathe Part Loading/Unloading

Read about how you can automate the loading/unloading of your CNC lathes to reduce the labor cost on longer running jobs.

-

Checklist for Lights-Out Manufacturing

Many shops of various sizes are trying to hop on the lights-out bandwagon. This article looks at some things to consider and check out before “hopping.”

-

Simplifying Machine Load/Unload Automation

Today, lower part volumes and frequent change-over are changing the offerings of some automation integrators. Standard, off-the-shelf components are being engineered to work together in a large variety of applications and, in some cases, are even portable so they can be moved from machine tool to machine tool.