Contraction Slowed in July

While the overall index was down, mid-size facilities did well in July.

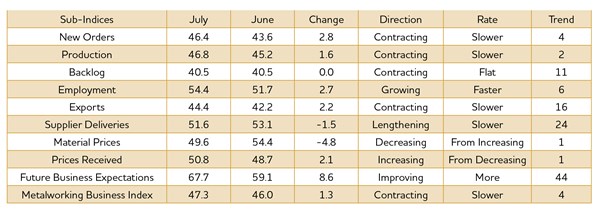

With a reading of 47.3, the Gardner Business Index showed that the production machining industry contracted for the fourth straight month in July. However, the industry contracted at a slightly slower rate than the previous month. But, other than the spike in the index in February and March this year, the index has trended down steadily since June last year.

New orders contracted at a slower rate than the previous month, but the index was still at its second lowest level since September 2013. Production contracted for the second month in a row, but the rate of contraction was slower than the previous month. The backlog index was unchanged from the previous month. However, in the previous 2 months, the backlog index was at its lowest level since September 2013. The trend in backlogs indicates that capacity utilization will move lower for at least the remainder of 2015. The employment index increased significantly, though. Without this increase, the overall index would have been even lower. Employment tends to be a lagging indicator in the economy. Exports continued to contract as the dollar remained relatively strong. Supplier deliveries continued to lengthen, but at a slower rate than most of the last 2 years, which indicates there is increasing slack in the supply chain.

Material prices contracted for the first time since July last year. The trend in this index has been down since material prices increased at their fastest rate in June last year. Prices received increased for the first time since March this year. The combination of material prices and prices received should have helped the bottom line in July. Future business expectations rebounded sharply in July. The index was slightly above its historical average.

While the overall index was down, mid-size facilities did well in July. Companies with 50-99 and 100-249 employees both had an index of 55.1. For the companies with 50-99, their index has been at least this high every month but one this year. For the companies with 100-249 employees, this was their first month of growth since April. There was limited response from plants with more than 250 employees, but their index was below 40 for the third time in 5 months. Shops with 20-49 employees have contracted at an accelerating rate for 3 months. Shops with 1-19 employees have contracted every month but one since June last year.

The Southeast was the fastest growing region in July. It has grown twice in the previous 3 months. The Northeast has also grown twice in the previous 3 months, although its index has been lower than the Southeast all 3 of those months. The North Central-West and North Central-East contracted at a similar rate. The West contracted for the third time in 4 months. The South Central has had index below 40 in 6 of the previous 8 months.

Future capital spending plans fell to their second lowest level since the survey began in December 2011. Compared with 1 year ago, they have contracted more than 40 percent in 3 of the previous 4 months.

.JPG;width=70;height=70;mode=crop)