Gardner Business Index, Precision Machining: November – 38.8

The Gardner precision machining business index showed that the production machining industry contracted for the eighth month in a row and at its fastest rate since the index began in December 2011.

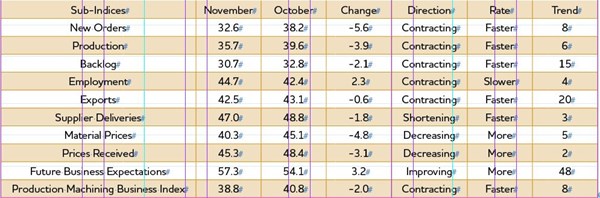

With a reading of 38.8, the Gardner precision machining business index showed that the production machining industry contracted for the eighth month in a row and at its fastest rate since the index began in December 2011. This was the second month in a row that the index contracted at its fastest rate. Other than a sharp upward spike in the first quarter of 2015, the index has generally trended down since January 2014.

New orders have contracted eight consecutive months. In November, they contracted at their fastest rate since the index began. Production contracted for the sixth straight month. It was at its lowest level since December 2012. Generally, the new orders index has been lower than the production index for the last 20 months. Therefore, the backlog index contracted for the 15th month in a row. It has taken a particularly sharp plunge since September. Employment contracted for the fourth consecutive month, although the index did improve from the previous month. Because of the strong dollar, the export index has contracted since March 2014. Supplier deliveries shortened for the third month in a row. The trend in supplier deliveries indicated slack within the supply chain since suppliers were more able to meet customers’ needs.

The material prices index contracted for the fifth month in a row. In November, the rate of price decreases was the fastest since the index began. And, the index has steadily fallen since its all-time peak in June 2014. The trend in the material prices index mirrors what is happening to commodity prices generally because of the weak global economy. Prices received at machine shops decreased for the fourth time in 6 months. Prices received decreased at their fastest rate since the index began. While future business expectations have fallen significantly since July, they did improve somewhat in November.

Facilities with more than 250 employees contracted at a significant rate for the second time in 3 months. And, plants with 100-249 employees contracted at a significant rate for the third month in a row. It was the declining business conditions at these larger facilities that has caused the total index to fall in recent months. Companies with fewer than 100 employees have contracted at a similar rate each of the previous 3 months.

All six regions contracted in November. The West contracted at the slowest rate and was much stronger than the other regions. The Northeast and Southeast had an index just above 40 while the index for the North Central-West and North Central-East was in the mid 30s. The South Central saw its index fall to 25, which was its lowest level since June 2015.

Future capital spending plans remained well below average. Compared with 1 year ago, they have contracted more than 33 percent the previous 6 months. However, in November, spending plans reached their highest level since June 2015.

To see the historical breakdown of our business index and each of its subindices, click here.

.JPG;width=70;height=70;mode=crop)