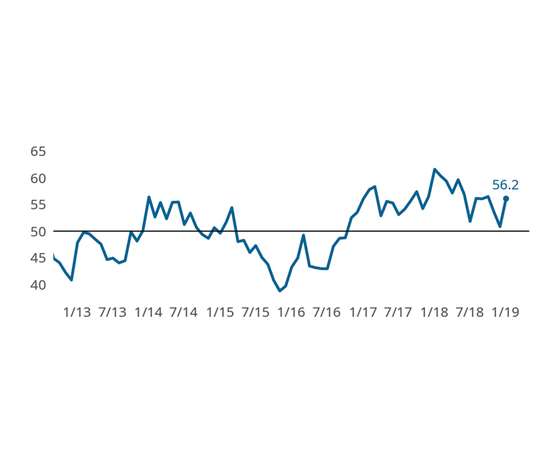

Index Rebounds on Production and New Orders

January mirrors the growth rate during the peak of the 2017-2018 business cycle.

#columns

Registering 56.2 for January, the Gardner Business Index (GBI): Precision Machining Index rebounded from December’s two-year low reading. Over the 2017 and 2018 calendar years, the Production Machining Index averaged 56.2, marking the fastest and longest expansionary period of any business cycle in Gardner’s recorded history. The latest reading is 9.3 percent lower when compared with the all-time high reading recorded in January 2018. Gardner Intelligence’s review of the underlying components of the Index revealed that the Index’s rebound from December was driven by production, supplier deliveries and new orders. In contrast, backlogs, exports and employment brought the index—a calculated average of the components—lower. All components of the index expanded during the month.

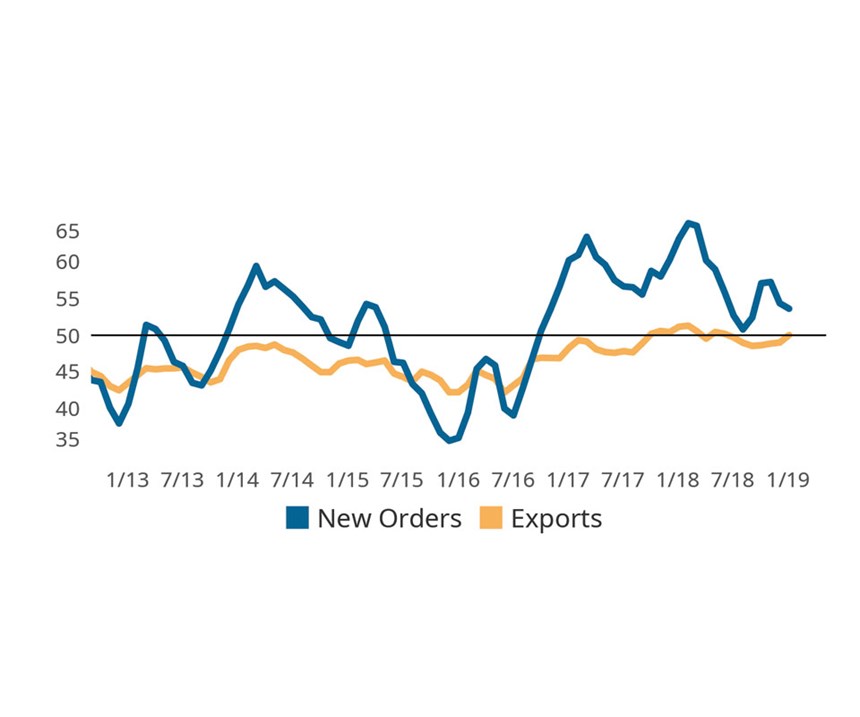

January’s readings for production and new orders experienced usually large upward changes. The production component of the Index, which last month recorded its first contractionary reading in over two years, rebounded by more than 15 points to be the leading component in January. The latest production reading is more than four points higher than the average production reading over the last two years. Similarly, new orders also experienced a strong expansionary reading in January, which was a contrast from the slowing growth and contractionary reading posted during the fourth quarter.

Beginning with the second-half of 2018, Gardner has experienced heightened volatility in readings for exports, new orders and production. This heightened volatility may express the volatility associated with normal economic cycle behavior compounded with more political uncertainty as international trade relations between the U.S. and many of its significant trade partners continues to be modified and renegotiated. Slowing and, at times, contracting export readings during the second half of 2018 pulled new orders readings lower. In response, manufacturers reduced backlogs to moderate production volumes. The latest readings may indicate that domestic economic growth may be more than sufficient to overcome potential weakness in foreign demand.

RELATED CONTENT

-

6 Tips for Training on a Swiss-Type Lathe

There are nuances to training a person to effectively operate a Swiss-type lathe. A shop I visited a while back offers some suggestions.

-

Reduction of Lead in Aluminium Alloys

Eural has developed free-machining aluminum alloys, including lead-free and tin-free alloys.

-

Manufacturing Knowledge is Power

The Knowledge Centers with video produced by brands such as Production Machining on the IMTS spark online platform take deep dives into technology and trends related to various CNC machining and manufacturing topics.

.jpg;width=70;height=70;mode=crop)