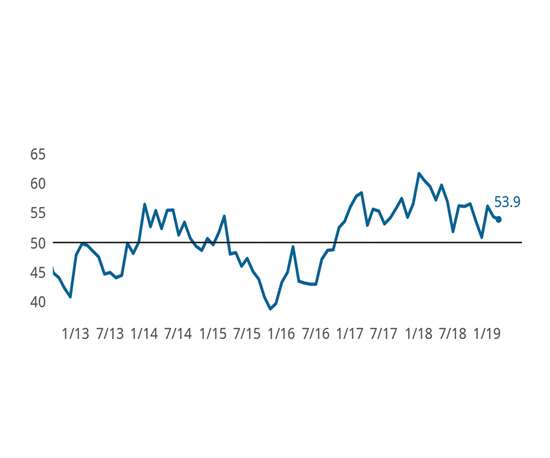

Machining Index Surprises with Strong First Quarter Expansion

The Gardner Business Index: Precision Machining registered 53.9 during March, bringing the first-quarter average reading to 54.8.

#columns

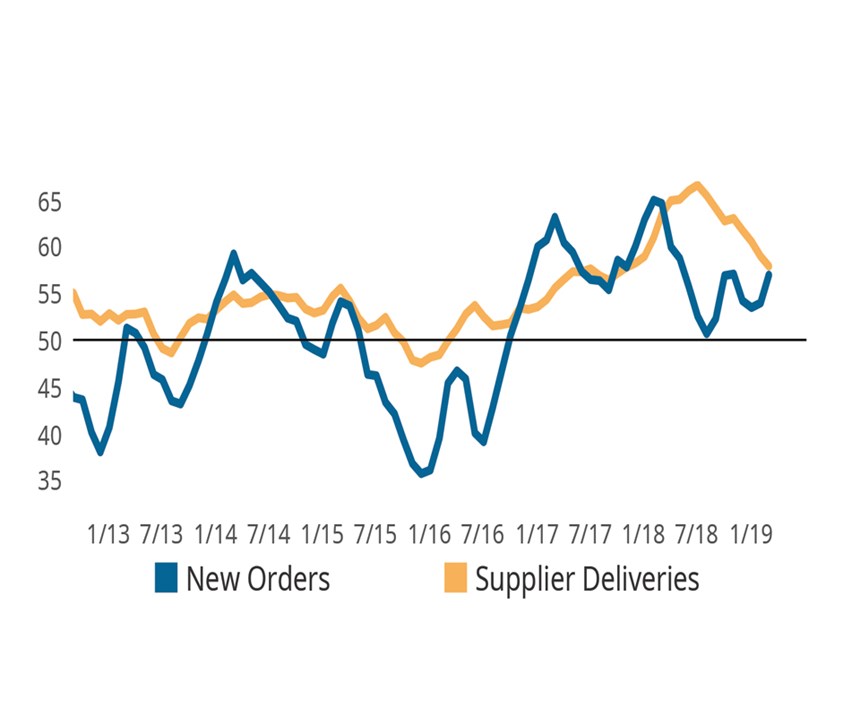

The Gardner Business Index: Precision Machining registered 53.9 during March, bringing the first-quarter average reading to 54.8. Compared with the past eight quarters—which capture almost all the expansion experienced in the current business cycle—the latest quarterly reading was higher than four of the last eight quarterly readings. This is no small feat considering that many market analysts believe that the economy is at the late-cycle stage. This limited outlook is understandable considering that the GBI: PM peaked in January 2018 and that compared with the same month one year ago, the Index is 9.9 percent lower, indicating much slower, but still positive industry growth. Gardner Intelligence’s review of the underlying components of the Index revealed that it was driven foremost by an increase in new orders followed by supplier deliveries and production. The Index—a calculated average of the components—was pulled lower modestly by employment and further by backlogs and exports. All components less exports expanded in March.

The surprise expansion in new orders during March marks the first time since January 2018 that new orders was the fastest growing component of the Index. Based on past analyses, an expansion in new order often has positive lagged effects on many of the other components of the business index. In past research, when the expansion in new orders is relatively larger than that of production, backlogs expand almost immediately, and production frequently expands in the following month. Furthermore, an increase in new orders activity is frequently correlated to additional supplier deliveries two to three months afterwards. The influence of new orders on other business index components was particularly evident at the peak of the business cycle in early 2018. The impact of new orders in January resulted in elevated production and at least 12 months of elevated supplier deliveries between March 2018 and present.

If April’s data sees additional strong growth in new orders and no change in export trends, the production machining industry may expect to experience solid expansion during the second quarter of the year.

RELATED CONTENT

-

The Basics of Cleaning with a Parts Washer

Better Engineering answers the question of “What do I need to know about an aqueous parts washer and its process?”

-

Manufacturing Knowledge is Power

The Knowledge Centers with video produced by brands such as Production Machining on the IMTS spark online platform take deep dives into technology and trends related to various CNC machining and manufacturing topics.

-

Good Bonding and Coating with Contact Angle Measurements

Darren Williams answers common questions about using a contact angle measurement to determine part cleanliness. Using water to test cleanliness reveals the effectiveness of a cleaning process.

.png;maxWidth=970;quality=90)

.jpg;width=70;height=70;mode=crop)