September Shows No Change

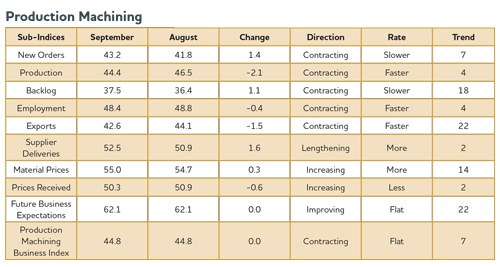

With a reading of 44.8, Gardner’s precision machining index showed that the rate of contraction was unchanged in September.

With a reading of 44.8, Gardner’s precision machining index showed that the rate of contraction was unchanged in September. The index has virtually remained unchanged since June this year.

Half of the sub-indices were better than reported in July while the other half were worse. Once again, supplier deliveries made the biggest improvement in September as they lengthened for the second month in a row. New orders made a similar jump, although they continued to contract at their second fastest rate since December 2012. Backlogs also recorded a slightly higher index in September, but they remain mired in a contraction that began in April 2012. The production sub-index fell the most, nearing its fastest rate of contraction since December 2012. Exports contracted at a faster rate. They have contracted consistently since the index began in December 2011. Employment contracted at a slightly faster rate in September.

Material prices increased at a slightly faster rate in September. However, this sub-index is near its lowest level since November 2012. Prices received saw a modest increase, which has been the case throughout this year.

Also throughout this year, smaller facilities have held the index down. But, facilities with fewer than 50 employees saw some improvement in their index level in September.

Business activity was at its highest level since May. However, facilities with more than 50 employees have seen weaker business conditions in recent months. In particular, facilities with 100-249 employees, which grew 5 of the first 8 months in 2013, saw their index drop to 40.8 from 52.4.

Every region contracted in September for the second consecutive month. However, four of the regions—East North Central, Pacific, South Atlantic, and West North Central—did see a higher index in September. The East North Central contracted at its slowest rate since May. The West North Central contracted at the fastest rate.

Planned capital expenditures were at their second lowest level since November 2012. They were 2.2 percent below the level of September 2012. This was the second month in a row that 1-month rate of change contracted.

.JPG;width=70;height=70;mode=crop)