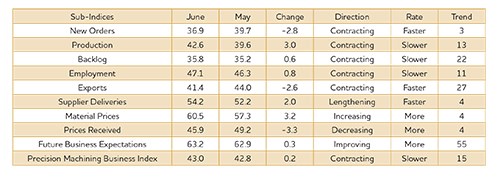

Gardner Business Index: Precision Machining, June 2016 - 43.0

Companies with 50-99 employees expanded for the fourth straight month.

With a reading of 43.0, the Gardner Business Index showed that the precision machining industry contracted for the 15th month in a row. While the index did improve slightly from the previous month, it has been relatively unchanged the previous three months.

New orders contracted for the third month in a row. The index has fallen sharply the previous three months and was near its lowest level ever. Production contracted for the 13th straight month, but the rate of contraction decelerated compared with the previous two months. The backlog index contracted for the 22nd consecutive month, putting the index near its lowest level of the last two years. Employment continued to contract in June, although the rate of contraction was slower than the previous two months. Even though the value of the dollar has moderated in recent months, exports remained mired in contraction as global trade has slowed. Supplier deliveries lengthened for the fifth time in six months.

The material prices index has increased sharply since December, with prices actually increasing the previous four months. In June, the rate of increase in material prices was the fastest since October 2014. Prices received at precision machine shops decreased for the fourth consecutive month. The index fell to virtually its lowest level since the survey began. Future business expectations were virtually unchanged for the second month in a row. The level of expectations still was significantly higher than the second half of last year.

Facilities with more than 250 employees contracted for the fourth time in five months. But, the index improved to its highest level since March. Plants with 100-249 employees contracted for the fifth month in a row, but the rate of contraction has decelerated each month. Companies with 50-99 employees expanded for the fourth straight month. In two of those four months, their index was above 55. Companies with 20-49 employees contracted for the third month in a row after a single month of growth in March. Shops with fewer than 20 employees continued to contract, with the rate of contraction the second fastest since the survey began in December 2011.

For the second month in a row, all six regions contracted. While the Southeast region was the best performing region the previous five months, it was the worst performing region in June. In April its index was 59.3, but it had fallen to 35.7 in June. From best to worst, the other regions were the Northeast, North Central-West, North Central-East, West, and South Central.

Future capital spending plans for the next 12 months averaged less than $400,000 per plant for the fifth time in seven months. Compared with one year ago, spending plans in May were down 37 percent.

.png;maxWidth=970;quality=90)

.JPG;width=70;height=70;mode=crop)