Index Contracts in September After a Promising August

All components report lower readings after August expansion.

#columns

Precision Machining Business Index: The Precision Machining Index reported a slight contraction in overall business activity for September. Reversing course after reporting expanding conditions just one month ago.

The Gardner Business Index: Precision Machining had a contractionary September reading of 49.4, which was unexpected as the Index over the prior months leading up to August’s expansionary reading had been consistently reporting a trend of slowing contraction for the industry. Unfortunately, September’s results were disappointing with all components reporting lower absolute readings compared to just one month ago. The weak but expansionary readings for both production and total new orders were insufficient to offset September’s quickening contraction in employment, export and backlog activity.

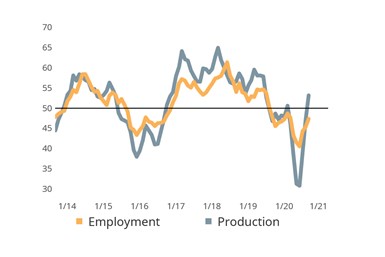

Expanding Production Activity Slowing Contraction in Employment Activity: Historically, employment activity readings parallel those of production. Encouraging production activity readings in both August and September have slowed the contraction in employment activity.

September’s respondents reported greater production activity relative to new orders, potentially explaining the quickening contraction in backlog activity during the month. Joining this trend were employment and export orders activity, both of which registered their first quickening contraction readings since at least June.

The weak readings for the month were uneven with quickening contraction in activity occurring in the Western and South-Central regions of the United States. Survey data (when segmented by end market served since May 2020) indicate that many of production machining’s most important markets (including electronics, job shops and industrial motors markets) are still experiencing slowing contraction.

About the Author

Michael Guckes

Michael Guckes is chief economist at Gardner Intelligence, the research and market intelligence division of Gardner Business Media. He provides forecasting, modeling and consulting services to clients and provides content for all Gardner brands. For more information about Gardner’s Business Index, visit gardnerintelligence.com.

RELATED CONTENT

-

Introduction to Industrial Artificial Intelligence

The systematic implementation of Industrial Artificial Intelligence enables secure data sharing among manufacturers, remote monitoring and operations, managing geographically distributed assets and more.

-

Use Social Media to Attract Young Manufacturing Talent

Nicole Wolter, president of HM Manufacturing and a millennial, suggests tips for creating a social media feed that attracts young people to manufacturing.

-

7 Muda Wastes Every Machine Shop Should Eliminate

Applying lean manufacturing concepts, the Flexible Production method can help put a stop to production wastes, specifically for those who use transfer machines or machining centers.

.jpg;width=70;height=70;mode=crop)