May Rate of Contraction Unchanged

New orders have contracted for 2 months after a surge in new orders in February and March.

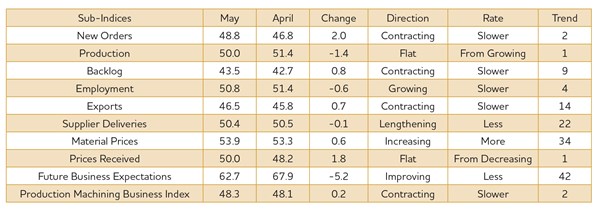

With a reading of 48.3, the Gardner Business Index showed that the production machining industry contracted at a rate virtually identical to the previous month. April and May have been the industry’s worst performing months since September 2013. Compared with 1 year ago, the index contracted 13 percent. This was the fifth straight month of contraction and the fastest rate of contraction month over month since March 2013. On an annual basis, the industry was still growing in May, but that will likely change in June.

New orders have contracted for 2 months after a surge in new orders in February and March. Production was unchanged in May, which was the first month production did not grow since December 2013. Backlogs continued to contract at a fairly significant rate. Compared with 1 year ago, backlogs have contracted for 8 consecutive months. The overall trend shows that capacity utilization will continue to grow at a slower rate in future months. Employment had a modest gain in May. The increase was significantly below almost every month since January last year. Exports continued to contract, but the rate of contraction has been slowing somewhat since October.

Material prices have increased each of the previous 2 months. However, the rate of increase was still the lowest in almost the last 3 years. Prices received were unchanged from th previous month. Over the last year, the rate of increase in material prices has fallen sharply while the change in prices received has remained relatively steady. Therefore, the net effect of material prices to prices received has been positive for precision machining companies. The future business expectations index has fallen significantly the previous 2 months. In May it was at its lowest level since September 2013. The current level was almost 10 percent below the average level of the last 4-plus years.

Plants with 100-249 employees contracted for the first time since November. The drop in the index was very sharp, falling to 42.9 from 55.1. Facilities with 50-99 employees continued to see strong growth as their index has been close to 60 since October. Shops with 20-49 employees contracted for the first time in 4 months. And, the smallest shops, those with fewer than 20 employees, remained mired in contraction.

The Southeast broke out of its contraction to become the fastest growing region in May. The West grew almost as fast as the Southeast and grew for the fourth time in the previous 6 months. The Northeast was the only other region to grow in May, and it has grown 5 of the previous 7 months. Both the North Central – East and North Central – West contracted in May after growing every other month this year.

Future capital spending plans improved noticeably in May after getting pummeled the previous 4 months. In May, spending plans increased almost 25 percent compared with 1 year ago. Also, spending plans were above the historical average for the first time since December. However, the annual rate of change contracted for the second month and will likely contract for another quarter or two.

.JPG;width=70;height=70;mode=crop)