Manufacturing Outlook Sees Growth and Transformation

Gardner Intelligence believes that manufacturing will experience modest expansion in 2018 with U.S. machine tool orders up approximately 5 percent.

Forecasting markets under the best of circumstances is always a challenge; adding natural disasters and political climate to the list of factors impacting markets only makes the job more difficult. Fortunately, most unplanned events are temporary, allowing deep-rooted drivers of market conditions, with time, to make forecasting a more reasonable task. Looking at the data of those deep-rooted drivers through the third quarter this year, Gardner Intelligence believes that manufacturing will experience modest expansion in 2018 with U.S. machine tool orders up approximately 5 percent.

The reasons for this forecast include strong, worldwide economic growth and growing corporate profits across a range of industries. In addition, machine tools play an essential role in taking technological developments from the latest in high-efficiency turbines to electric vehicles from the drawing board to the factory floor. The production ramp-up required to bring such goods to market in several of the largest industries will continue to grow machine tool purchases in 2018.

As compared with the average business cycle—which experiences slightly less than six years of expansion—should the current business cycle last through 2018, it will have lasted almost nine years. Among the many factors responsible for this cycle include the availability of “cheap” credit because of unprecedented easing of monetary policy. This has made it possible for consumers to purchase durable goods with minimal capital investment. The result of such “cheap money” has not only increased demand for goods, but also the appreciation of assets including real-estate and financial assets, which further feed consumer sense of wealth, thereby encouraging additional spending.

Employment. The two drivers of productivity are labor and capital, as all production in some form must come from the combination of these two resources working together to produce the goods and services consumed in an economy. Many years of declining birth rates and the retirement of baby boomers in the U.S. has resulted in labor force growth below one percent. In 2017, the shortage of labor became particularly acute as manufacturers identified a lack of available and skilled labor as a primary concern to their businesses. Because labor shortages of this nature cannot be easily nor quickly resolved, the impact to productivity because of a shortage of labor can only be offset by investing more capital into operations. As a result, those developed nations with limited labor will have no other option than to find technological solutions to sustain economic growth above the rate of population growth. This suggests that the successful machine tool builder of the 2020s and even 2030s will provide highly automated equipment able to do much more of the work currently performed by labor as labor becomes difficult to find and/or too expensive.

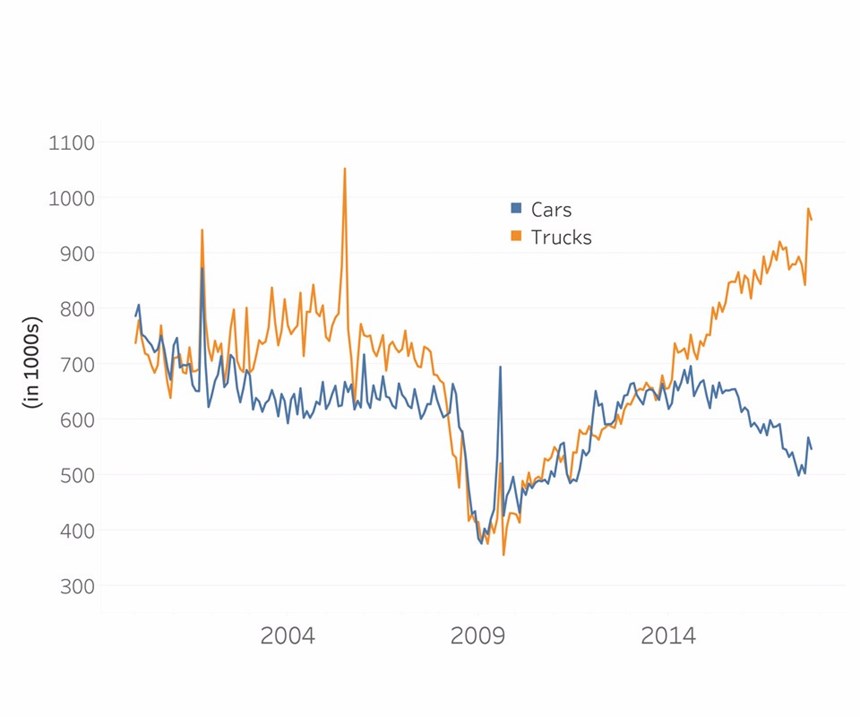

Automotive. Broad measures of the automotive industry through the third quarter of 2017 reinforced the prior year’s trend of declining automobile sales being offset by strong sales in light truck and SUVs. Because strong sales of trucks and SUVs in 2016 more than offset the decline in automobiles in the year, 2016 ended with 17.6 million total vehicles sold, giving the industry its record-setting seventh consecutive year of increasing total vehicle sales. Factoring out replacement demand from hurricanes in 2017, flat to slightly decreasing truck sales in the second and third quarters of this year are not able to offset the decline in automobile sales.

Financial incentives and low interest rate financing have provided important tailwinds to the industry in the years since The Great Recession. Average vehicle financial incentives for new vehicles during mid-2017 have exceeded $3,500, an increase of approximately 10 percent over 2016’s average financial incentive level. Low-interest financing and longer duration loans have incentivized many consumers to finance vehicles at low monthly payment levels, which they may not be able to otherwise afford. However, data shows dollar lease volumes peaked at the end of 2016 and have moved lower throughout 2017.

While it is likely that 2017 sales volumes will show a modest decline over the prior year’s sales volumes, that is not to indicate that the industry should prepare for a significant decline. An examination of the last several decades of total vehicle sales data shows that vehicle sales peaks can be followed by many years of healthy sales. Vehicle sales in 2000 at 17.8 million vehicles were followed by two years of healthy sales volumes of 17.5 and 17.1 million units, respectively.

The transformation taking place in the automotive industry presents significant opportunities for the machine tool industry. As the industry moves toward new powertrain models including hybrid and fully-electric vehicles as well as toward autonomous vehicles, the need for manufacturing and technological partnerships become obvious. Most, if not all, major car manufacturers have formed partnerships with multiple technology firms to produce what each anticipates will be a winning platform in a few short years. The regulations in the U.S., Europe and China are quickly moving away from the traditional internal combustion engine and instead toward highly efficient models. This has pushed the expected number of new models in 2018 and 2019 to new heights compared with recent history and may bolster machine tool consumption along much of the automotive supply chain.

Aerospace. The aerospace industry has experienced incredible growth in recent years as evidenced by a $1 trillion backlog of jet orders split almost evenly between Boeing and Airbus at the beginning of 2017. The demand for new jets has been driven in large part by the demand for highly efficient narrow-body jets, including Boeing’s 737 model and Airbus’ A320 family of models. With such strong aircraft demand, jet engine manufacturers are also experiencing robust demand for their latest turbines. Gardner Business Index data reported by the aerospace industry provides clear evidence of the strong growth through 2016 and 2017.

Overall, passenger and freight demand in recent years has been excellent. According to the International Air Transport Association, full-year global passenger traffic in 2016 grew seven percent over the prior year, beating the 10-year average growth rate of 5.5 percent. That growth in only 2016 represents 242 million air trips. The Asia Pacific region in 2016 also retained its title as the largest by number of passengers with 35 percent market share and 1.3 billion passengers, an increase of 11.3 percent annual growth. Europe and North America ranked second and third, respectively, with 26 percent (992 million passengers) and 24 percent (912 million passengers) market shares.

Next year looks like it will ride the wave of growth first started in late 2016 and early 2017. Gardner Intelligence believes that machine tool consumption will increase between five and 10 percent at least through the first half of 2018 and potentially climaxing in September at the International Manufacturing Technology Show (IMTS). The shops that will succeed in the coming years will be those that find sales opportunities in the midst of the transformation taking place in the automotive industry as new partnerships evolve between traditional car manufacturers and new technology firms. Demand in the aerospace industry for extremely efficient aircraft and especially engines will create opportunities for machine tool builders able to provide the high-tech, high-precision, intricate part machine tools necessary to meet strict environmental rules and desired low operating costs by airlines. Other industries such as medical and energy will also undergo their own transformations, and those machine tool builders able to keep abreast of the changes taking place in these industries will find themselves outperforming their counterparts.

Read Next

How To (Better) Make a Micrometer

How does an inspection equipment manufacturer organize its factory floor? Join us as we explore the continuous improvement strategies and culture shifts The L.S. Starrett Co. is implementing across the over 500,000 square feet of its Athol, Massachusetts, headquarters.

Read MoreFinding the Right Tools for a Turning Shop

Xcelicut is a startup shop that has grown thanks to the right machines, cutting tools, grants and other resources.

Read More

.jpg;width=70;height=70;mode=crop)