Disrupted supply chains, which were for a short while the wind in the sails of American manufacturers, are now becoming an anchor that slows American manufacturing down.

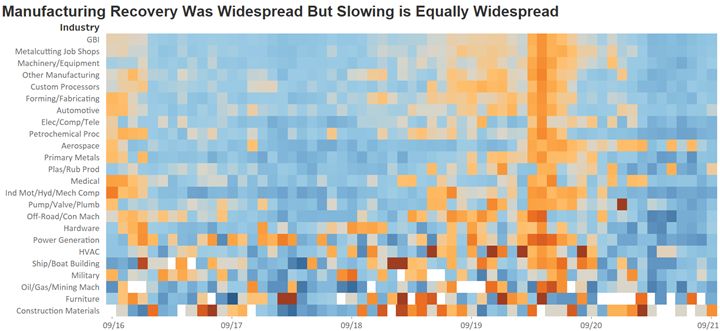

As the economy was locked down in April 2020, the service economy came to a grinding halt. Manufacturing was briefly affected by the lockdown, but in a few months manufacturing was one of the, if not the only, bright spots of the economy. The Gardner Business Index (GBI) showed that by the summer of 2020 many manufacturing sectors were growing once again. By the fall, the majority of manufacturing was roaring back to life. And, by the spring of 2021, every single manufacturing market tracked by the GBI was growing at a significant rate.

A major reason for the surge in U.S. manufacturing was disrupted international supply chains that caused U.S. OEMs to reorient their supply chains to more domestic manufacturing. Yet, these disrupted supply chains, which were for a short while the wind in the sails of American manufacturers, are now becoming an anchor that slows American manufacturing down. Since the late summer of 2021, almost every manufacturing sector tracked by GBI displayed slowing growth.

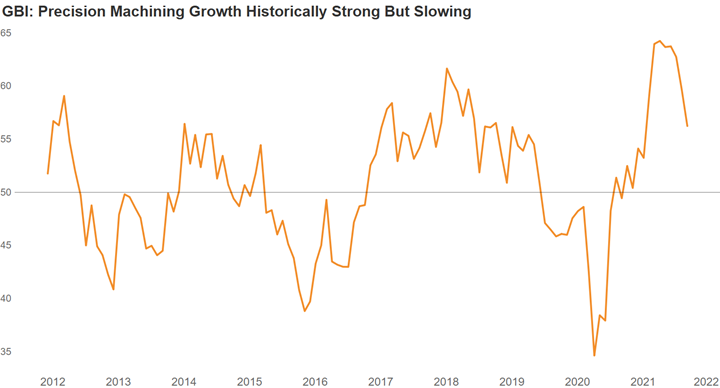

And, due to the nature of the calculation of the GBI, the growth was only as strong as it was because supply chains remained extended. The GBI: Precision Machining provides an excellent example of what has happened. When manufacturing is growing, it is expected that supply chains will lengthen as all manufacturers need to catch up with the dramatic increase in orders. Normally, the supplier deliveries index will peak at a similar level but only after the other components of the GBI peak. This is exactly what happened in the expansion during 2017 and 2018.

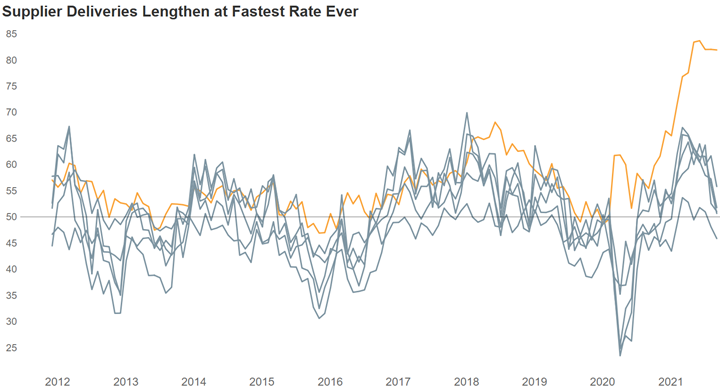

In the current expansion, the lengthening of supplier deliveries exceeded anything manufacturing has ever seen. Supplier deliveries are the orange line in the third chart below (Supplier Deliveries Lengthen at Fastest Rate Ever). Notice that instead of contracting with all of the other sub-indices in 2020, the supplier delivery index increased, indicating a lengthening of the supply chain despite overall precision machining activity declining. This was a problem, but an understandable one because of the lockdowns.

Each square represents one month. Blue squares are growth. Orange squares are contraction. The darker the color, the faster the growth or contraction. In March and April 2021, every industry tracked by the GBI was growing faster (blue squares getting darker). For almost every industry, accelerating growth continued until June 2021. Since that time, almost every industry was growing slower (blue squares getting lighter).

As the precision machining industry recovered, supply chains never had a chance to catch. Therefore, the supplier deliveries index rose even higher, indicating that supply chains were becoming more and more stretched. By June 2021, the supplier deliveries index reached an all-time high of 83.8, and it has remained close to that level. At the same time, every other GBI component has declined significantly.

So, the supply chain disruption that once helped manufacturing is not hurting manufacturing. Manufacturers, including precision machine shops, struggle to get the materials, components and supplies they need to make their products. When these components can be procured, they are costing significantly more. While inflation is often said to always be a monetary problem, the current supply chain disruptions from shutting down the global economy are leading to rapidly rising prices in numerous commodities.

An interesting piece by Nick Colas of DataTrek Research showed how the phrase “supply chain disruption” has become a type of shorthand to link together and explain product shortages and inflation. His most interesting point, though, was that the current supply chain disruption reminded him of

In September, the GBI: Precision Machining was 56.3. While the rate of growth was historically strong, it has slowed noticeably since its peak in April 2021. Also, the current level of growth is somewhat misleading as the components of the index are moving out of sync with one another.

the 1973 oil shock. He stated that the oil embargo caused U.S. inflation to rise so rapidly because the economy was structurally set up for low energy prices. We have a similar problem now because the economy is structurally set up for globally distributed supply chains with just-in-time deliveries made possible by lean manufacturing. And, now that that structure has been disrupted, prices are rising rapidly. Ultimately, it could take a significant rise in interest rates and another recession to put an end to the current inflation and supply chain disruption as it did in the late 1970s and early 1980s.

There isn’t an industry that is not affected by these twin factors of supply chain disruption and inflation. But, there is another factor that is likely to affect manufacturing in 2022, which is the labor shortage. Manufacturing has dealt with the lack of skilled labor for at least a decade, if not longer. While it is not ideal, manufacturers have been able to cope with this lack of labor through increased automation, and will likely continue with the labor shortage in the same way.

However, what happens when the end markets important to many precision machine shops suffer their own labor shortages? Will they still demand the same number of parts from precision machine shops?

The orange line represents supplier deliveries while the gray lines are all the other components of the GBI:PM. Supply chain disruption continues to cause major problems in the precision machining industry as supplier deliveries (82.0 in September) are lengthening at virtually the fastest rate in the history of the GBI: Precision Machining. The extreme supply chain disruption is artificially inflating the growth in the industry as every other subindex is growing significantly slower or contracting since the spring of 2021.

For example, the health care industry was already struggling with a shortage of nurses. Now, because of vaccine mandates, a seemingly small but significant percentage of nurses (and other health care providers) could be losing their jobs. Fewer health care providers could hinder the “production” of health care. Health care providers are not easily replaced with automation. So, this could result in decreased demand for the types of parts precision machine shops manufacture for the medical industry.

Or, consider the air travel and aerospace industry. In October, Southwest Airlines was forced to cancel thousands of flights. Initially, the company claimed the cancellations were due to weather. Others speculated that the pilots and other crew members didn’t show for work as part of a “sick-out” as they used up their time off before being fired for refusing COVID-19 vaccines. Pilots are not easily replaced and cannot be automated. It would not take many pilots on a sick-out or fired from their jobs before there would be a significant reduction in the number of planes and parts needed for the aerospace industry.

By nature, manufacturers are resourceful and have the ability to solve many problems. However, many of the problems manufacturers are being faced with at the moment are seemingly self-inflicted. If the self-inflicted problems of supply chain disruption (economic lockdowns), rising inflation (massive amount of new money created because of the lockdowns) and labor shortages (likely exacerbated by vaccine mandates) were resolved, manufacturing would likely boom to restore depleted inventories. However, if these self-inflicted problems are left to fester, then manufacturing may face a significant recession.

About the Author

Steve Kline, Jr.

Steve Kline is the former chief data officer at Gardner Business Media Inc. and has produced forecasts for his family’s business and the metalworking and plastics industries. Mr. Kline has been working on Gardner’s Capital Spending Survey, the Gardner Business Index, and Top Shops benchmarking survey from 2008 to 2021. He graduated from Vanderbilt University with a degree in civil engineering and has an MBA with an emphasis in finance from the University of Cincinnati.

Related Content

An Investment in Hope and Second Chances

Rise Up Industries’ machine operator training program enables former gang members to find sustainable employment and successful reentry into society. It has recently expanded into a new facility in San Diego and support is always welcome.

Read MoreThe Value of Aligning Efforts to Promote Manufacturing Careers

Successfully building the next generation of manufacturers requires a team effort between employers, educators and parents. Each of these three groups has a tremendous impact on young people’s career decisions. Without the support of all three, we are unlikely to bridge the skilled labor shortage that threatens the future growth of our industry.

Read MoreReframing Work-Life Balance and Development Opportunities

Factors other than compensation can be the difference between keeping and losing a current or potential employee.

Read MoreThe Lost Art of Mastery

There is value to honing and mastering a craft. But it takes time and experience.

Read MoreRead Next

Production Machining Activity Slowed in Third Quarter

Third quarter activity was complicated by hiring and supply chain constraints

Read MoreHow To (Better) Make a Micrometer

How does an inspection equipment manufacturer organize its factory floor? Join us as we explore the continuous improvement strategies and culture shifts The L.S. Starrett Co. is implementing across the over 500,000 square feet of its Athol, Massachusetts, headquarters.

Read MoreFinding the Right Tools for a Turning Shop

Xcelicut is a startup shop that has grown thanks to the right machines, cutting tools, grants and other resources.

Read More

.JPG;width=70;height=70;mode=crop)