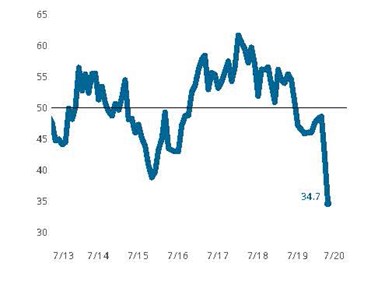

Business Activity Contraction Quickens as Economic Shutdown Endures

April’s New Orders and Production Activity Collapse as Index Falls to All-Time Low.

Business activity contracted sharply faster in April with a near 8-point contraction, sending the Index to an all-time low of 34.7. Over the last two months, the Index has fallen approximately 14 points, its greatest 2-month move ever.

Precision Machining Index: April experienced an extension of the initial COVID-19 contraction reported in March. Efforts to slow the spread of COVID-19 have resulted in a reduction of business activity that is without equal in the history of the Business Index.

Gardner Intelligence’s review of the underlying index components observed that the Index — calculated as an average of its components — saw several components move far below their historic lows in 2013 and 2015. New orders and production, along with backlog activity, led the Production Machining Index lower. New orders and production are often bellwether components of the remaining Index components.

As with last month’s report, we would like to remind our readers that these readings represent the breadth of change occurring within the production machining industry and are not to be confused with the rate of decline taking place. These low readings indicate only that a large proportion of manufacturers reported a decreased level of business activity, without quantifying the actual magnitude of the downward change.

Index of Prices Received and Material Prices Indicate Margin Compression: April’s index reading for prices received fell below 50, while the index for material prices remains weakly above 50. This spread encompassing the ‘50’ line implies that a growing proportion of firms are experiencing both an increase in input costs and simultaneously a price decline for their own production.

The reading for supplier deliveries remained elevated for a second month. As reported in March, the reason for this has to do with how the supplier delivery question is asked with the response options being ‘slower,’ ‘same’ and ‘faster.’ In normal times, when demand for upstream goods is high, supply chains cannot keep pace with these orders. The resulting backlog of supplier orders thus lengthens their delivery times. This delay causes our surveyed firms to report slowing deliveries and, by our survey’s design, elevates the supplier deliveries reading. The world’s efforts to slow the spread of COVID-19 has significantly disrupted supply chains worldwide. It is this disruption, as opposed to strong demand for upstream products overall, that has caused supplier delivery times to lengthen and elevate the reading.

Gardner Intelligence tracks all respondents by region and end markets served. All regions of the country reported similarly challenging business conditions with Southeast respondents reporting relatively better conditions than all other U.S. geographic regions. All end markets reported an accelerating contraction in business activity with those serving the machinery manufacturing market reporting the greatest activity contraction.

Read Next

Precision Index Contracts as Coronavirus Disrupts

Multiple Index Components Report Record Lows

Read MoreVIDEO: Gardner Intelligence Reviews 2019 Business Index

According to Gardner Intelligence, the 2019 Gardner Business Index was marked by slowing growth and contraction, but the amount of contraction is less than the growth of the past business cycle.

Read MoreFinding the Right Tools for a Turning Shop

Xcelicut is a startup shop that has grown thanks to the right machines, cutting tools, grants and other resources.

Read More

.jpg;width=70;height=70;mode=crop)