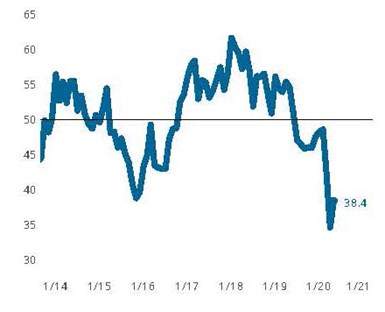

Production Machinists Report Slowing Decline in Business Conditions

Index signals decelerating contraction as all components report improved readings.

The Precision Machining Index moved modestly higher in May. Higher readings for new orders, production, exports, backlogs and exports (along with a decline in the supplier deliveries reading) were welcomed news as they indicate the first signs of a turn toward more typical business conditions.

The Gardner Business Index (GBI): Production Machining moved higher in May, registering 38.4 after setting an all-time low in April. For the first time since the government curtailed normal business operations to prevent the spread of COVID-19, all components of the Index moved toward more ‘normal’ levels. Excluding supplier deliveries, all components moved higher from their prior month readings — although each remained below a reading of 50. This situation signals that the industry is experiencing a slowing contraction, meaning that while conditions deteriorated further in the most recent month, they did so at a slowing rate compared to the prior month.

Machinists reported an increase in the cost of input goods from upstream suppliers, while also reporting weakening pricing power for their own products. The combination of these events is almost assured to reduce profitability for the machining industry.

The supplier delivery reading fell slightly in May which may indicate a turning point in the unprecedented disruption that affected upstream production and slowed deliveries earlier in the year. By the nature of how this question is asked, quickening supplier deliveries lower the Index’s reading. However, the resumption of upstream production and deliveries appears to be coming with an additional cost as May’s results showed a growing proportion of survey participants reporting higher material prices while also reporting weakening pricing power for their own products. The result of this widening spread across the ‘50’ or ‘no-change’ line suggests that profit margins are being compressed.

.jpg;width=70;height=70;mode=crop)