Gardner Business Index: Precision Machining March 2023

According to information gleaned from Gardner Business Intelligence surveys, GBI: Precision Machining component activity generally continued in March the ‘right’ paths observed in February.

#columns

According to Gardner Business Intelligence, the Gardner Business Index: Precision Machining undid in March the gain and growth achieved in February (see last month’s reading), losing 2.8 points and returning to January’s ‘flat’ index of 49.8.

GBI: Precision Machining component activity generally continued in March the ‘right’ paths observed in February.

- New orders activity just barely started growing in March, while backlog contracted at the same rate as February.

- Export activity contracted more slowly again in March.

- Primarily to support new orders, production and employment (which tend to move together in times of typical labor supply) expanded at faster rates in March. However, activity remains below levels observed for most of the preceding 24 months.

- Supplier deliveries continued to lengthen at a slower rate in March, which suggests the worst of the supply chain woes is behind us. Should the trend continue, supplier deliveries will shorten, which is a good thing for shops receiving materials, but a sign of softening volume overall.

- That the overall Gardner Business Index: Precision Machining was down while most components (reported as 3-month moving averages) expanded faster or contracted slower in March makes for heightened anticipation as to how the combinations will shake out, and potentially synch, come April.

Precision Machining Index

Precision Machining activity was down in March, closing at 49.8.

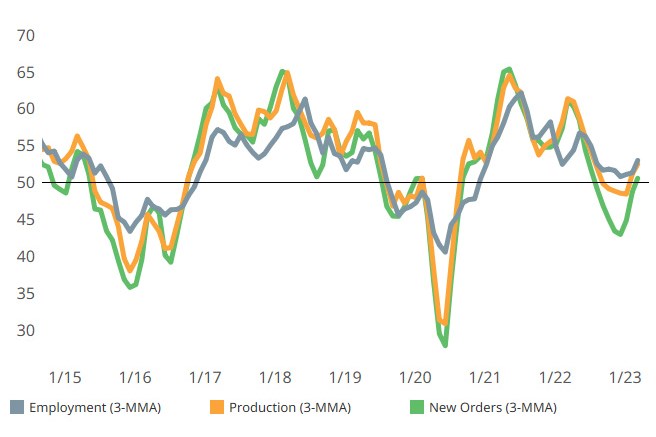

Key Components (3-month moving average)

Components, employment and production, expanded faster in March as new orders activity grew.

RELATED CONTENT

-

The Basics of Cleaning with a Parts Washer

Better Engineering answers the question of “What do I need to know about an aqueous parts washer and its process?”

-

Is the German Apprenticeship Model the Answer for U.S. Manufacturing?

This machine tool builder president and CEO is an ardent proponent of the German apprenticeship model and believes this concept could be applied here in the United States to address the skilled labor shortage.

-

What Does 2021 Have in Store for the Parts Cleaning Industry?

With a new opportunity to do good things in your organizations this year, I hope you use the parts cleaning section and this year’s and last year’s Parts Cleaning Conference as tools to succeed.