Large Plants Plan High Rates of Capital Spending in 2024

Gardner Business Media’s Capital Spending survey projects a modest decline of 7.4% in machine tool spending next year. While job shops are taking a wait-and-see posture, large plants plan robust spending with machining centers leading the way.

Last year, Gardner Intelligence’s Capital Spending Survey and Report projected that U.S. spending on machine tools this year would be down 19% from 2022, a more conservative take than most forecasters in this space. That projection is turning out to be accurate due largely to widespread uncertainty. The shortage of labor, rising interest rates and energy prices, lingering supply chain issues and a variety of other factors have all contributed to a wait-and-see attitude among many U.S. machine tool buyers, in particular job shops and smaller manufacturing enterprises. Our projection for 2024 has the U.S. machine tool market down another 7.4% next year, but there are bright spots, particularly among larger companies, and it is possible that the job shop market could be more resilient than our projection based on when the survey was taken this year.

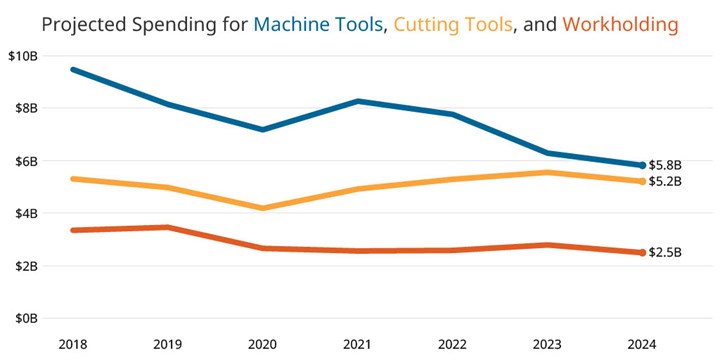

The 2024 Capital Spending Survey and Report from Gardner Intelligence projects that overall U.S. spending for machine tools next year will be $5.83 billion. Cutting tool spending will fall back 6.2% to $5.22 billion, and workholding spending will be down 10.6% to $2.50 billion.

Featured Content

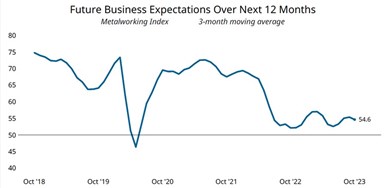

It’s important to note that the Capital Spending Survey is not a forecast. Rather, it is a projection of buyer intent based on responses to a survey conducted in July of this year, a time of significant uncertainty for smaller shops in general, including job shops, which is why we aren’t ready to write off that market just yet. At that time, according to Gardner Intelligence’s Metalworking Business Index, (which surveys many smaller enterprises) job shop activity had dropped to its lowest level since August 2020. Several industry insiders have shared a widespread view that while job shops were largely sitting on the sidelines this summer waiting for better clarity on their future business prospects, as well as more active orders on their books, larger companies continued to spend, some at very robust rates. As Gardner’s Industrial Buying Influence survey has found, job shops have shorter buying cycles for machine tools (about three months) than larger companies, generally based on more immediate needs. It comes as little surprise that many job shops were cautious about new investment during our survey cycle.

As AMT — The Association of Manufacturing Technology President Douglas Woods put it in their August USMTO report, “We are seeing industries focused on shorter-term projects reduce their spending, but at the same time, OEMs focused on longer-term production timelines have been increasing their spending, keeping orders at an elevated level.”

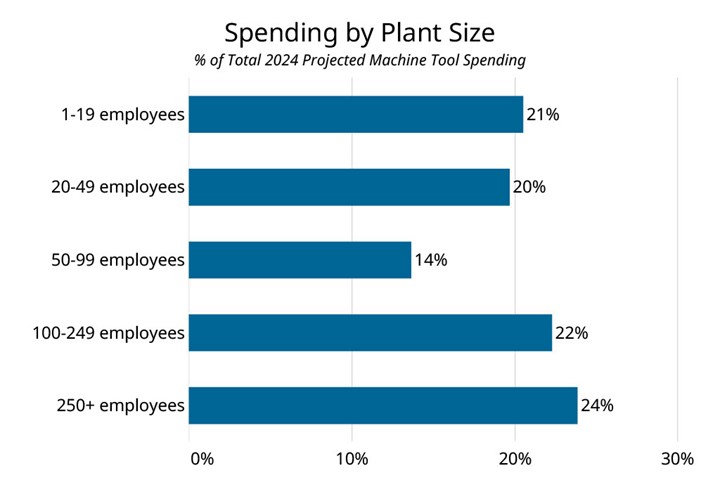

These trends are shown in our 2024 Capital Spending forecast, which projects that large manufacturers will account for a significantly larger portion of spending than is typical for this market. While job shops will account for some 31% of all spending at $1.84 billion, the mean level of job shop spending for the last three years has been higher, about 33.5% of the total. A reason for our very cautious optimism on job shop and small plant spending comes from the Gardner Business Index survey in which future business expectations showed an uptick to over 55 in August and September. The GBI is a diffusion index much like the Purchasing Managers’ Index (PMI) that measures the pace of activity in the metalworking market. A score of 50 indicates flat growth in activity or expectations; greater than 50 means more, and under 50 means less.

Large Plants Lead the Way

Looking solely by facility size, the large population of smaller shops is projected to spend less as a group in 2024, but once again, they will collectively spend more than larger shops, which are projected to spend about the same in 2024. Shops with 250+ employees, the only plant size projected to increase spending in 2024, drive the slight increase in spending among shops with 100+ employees.

Within the large shops (250+), the very clear leader in product spending will be on machining centers, projected to be more than $800 million, the highest level since 2019. Lathes and turning centers are next at more than $250 million, about 13% less than projected for 2023.

Machining centers also lead overall spending at about $2.69 billion, up some $200 million from the 2023 projection. Lathes and turning centers will be about the same as last year’s projection at about $1.6 billion. Combined, machining centers and turning machines will account for 73% of all machine tool spending followed by grinding machines (7%), screw machines (5%) and EDM (4%). Several industry insiders have told us that Swiss-Type turning centers continue to be a growth category within the overall turning market.

Few Surprises in Leading Industries

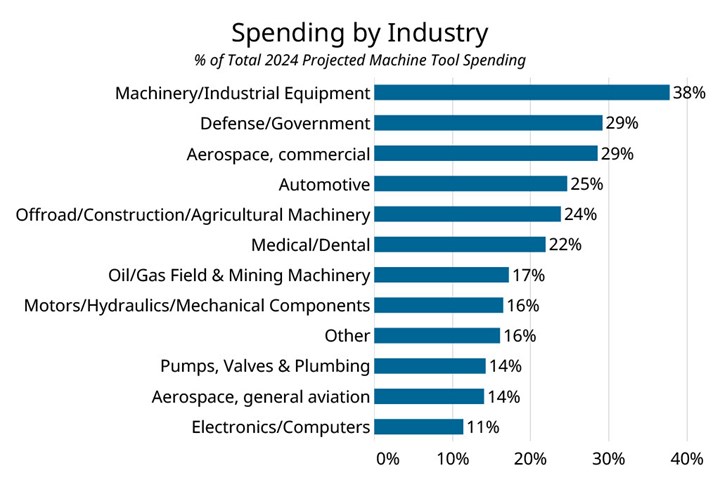

For a more complete picture of projected spending by industry in 2024, a survey question was added to solicit industries served beyond a facility's primary NAICS code designation, including job shops. That is, we ask what primary industries are served by a company, such as a job shop, and include those spending plans along with the primary NAICS categories rolled up for any specific industry. That collective view of projected spending by industry is what you see in the graph below.

With infrastructure spending finally kicking in, high worldwide demand for defense products and systems and the rising cost of oil it comes as little surprise that the related industries are very active in spending to serve increased demand. Commercial aircraft and automotive account for somewhat less of total spending by historical standards, though aircraft manufacturers are gearing up to serve increased passenger demands. According to Oliver Wyman’s Global Fleet and MRO Market Forecast 2023-2033, the worldwide commercial aviation fleet will expand 33% to over 36,000 aircraft by 2033. While that growth and surprising continued strength in auto sales is yet to be broadly evidenced in our capital spending projections, auto and commercial aircraft nonetheless rank third and fourth in total spending after Machinery/Industrial Equipment and Defense/Government.

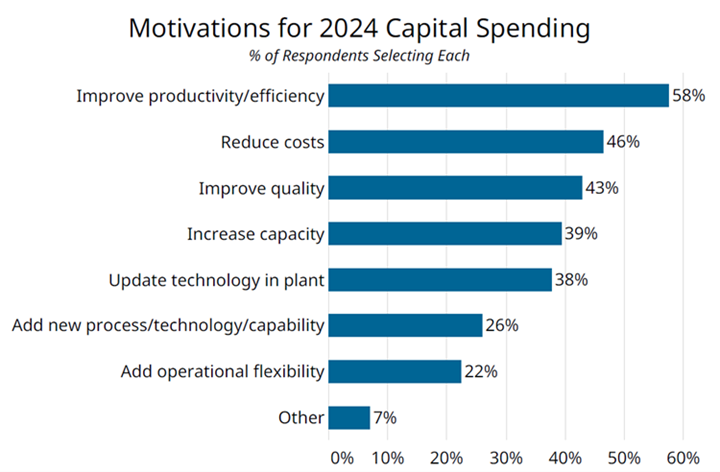

Little Change in Spending Motivations

While serving capacity demands were historically a primary driver in capital spending in the U.S. market, in more recent years that motivation has given way to demands for increasing efficiency, throughput and quality. This year’s survey continued these trends in no small way fueled by the dearth of skilled labor suffered by virtually all U.S. manufacturers large and small. By a significant margin, improving productivity/efficiency is the leading motivation for investment followed by cost reduction, quality improvement and then increasing capacity.

For more information on Gardner Business Media’s reports and services, visit GardnerIntelligence.com.

RELATED CONTENT

-

Economics of Production Machining: Are You in the Speed or Feed Tribe?

Optimizing for multiple factors, not just minimizing cost for a single factor, will lead to profitable production machining.

-

How Advancements in CNC Multi-Spindles Can Put You Ahead of Current Trends

Growing economic and labor pressures are making CNC multi-spindle turn/mill technology more viable than ever. This real-world comparison to a single-spindle lathe shows how.

-

Parting Off: The Case for Standardizing on Sawing

The value of rotary saw cutting for parting off operations could boil down to simple economics paired with process efficiency gains.