Precision Machining Activity Slows Decline

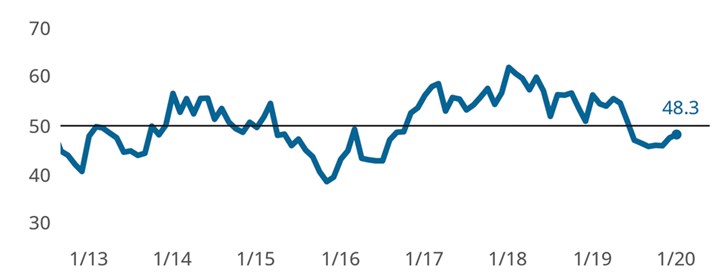

The Precision Machining Index moved higher during the first month of 2020, registering a modest increase to 48.3.

Precision Machining Index. The Precision Machining Index has made incremental progress towards the “50” mark during the last two months, indicating that the industry is experiencing a slowing contraction in total activity.

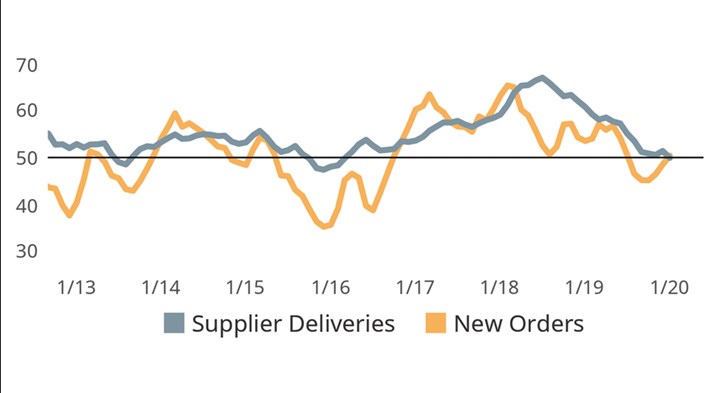

New Orders and Production Improve in 2020: Improving readings for new orders and production activity coupled with sustained activity in supplier deliveries has helped slow the contraction in the precision machining industry.

The Precision Machining Index moved higher during the first month of 2020, registering a modest increase to 48.3. Readings above 50 indicate expanding activity and values below 50 indicate contracting activity. The further away a reading is from 50 the greater the size of the change in activity. Gardner Intelligence’s analysis of the underlying Index components found that the Index was supported by expanding activity in exports followed by mildly contracting activity in new orders, supplier deliveries, production and employment. The Index—an average of its components—was pulled lower by the persistent and significant contraction in backlogs which has heavily weighed on the Precision Machining Index since June 2019. January’s results marked several firsts, including the first time in recorded history that the Index has been led by exports and the first time that exports was the only expanding component of the Index.

Among all industries tracked by Gardner Intelligence, precision machining faced some of the most severe headwinds in 2019 as weakening export and backlog activity in May foreshadowed contractionary readings in new orders, production, employment and supplier deliveries during the second half of the year. Despite 2019’s overall weak results, the fourth quarter of 2019 coupled with January’s readings indicate that the industry is in a decelerating contraction. If this trend holds, the industry may begin experiencing renewed growth later in 2020.

.jpg;width=70;height=70;mode=crop)