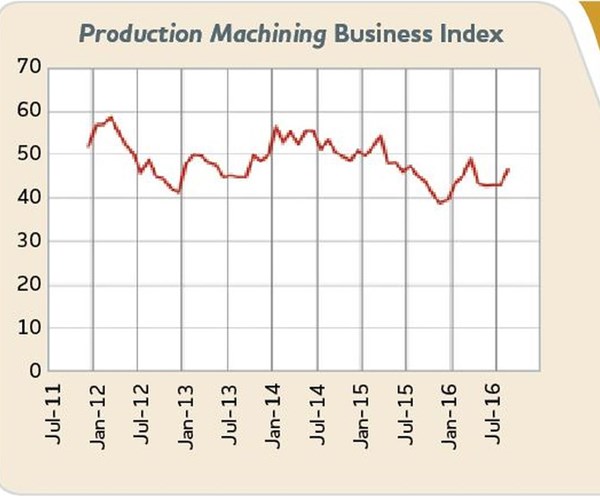

Precision Machining Index: August 2016 – 46.5

The index jumped to its second highest level since July 2015.

With a reading of 46.5, the Gardner Business Index showed that the precision machining industry contracted at a noticeably slower rate in August. The index jumped to its second highest level since July 2015.

In August, the new orders index grew for only the second time since March 2015. While the production index has contracted since June 2015, in August the index was close to flat. The backlog index remained quite weak, as the index was below 40 for the fifth straight month. However, the backlog has improved quite a bit since November 2015. Employment contracted for the 13th month in a row. Exports remained mired in contraction, although the index reached its second highest level since May 2015. Supplier deliveries shortened for the first time since February.

Material prices have increased since March. Even though the rate of increase decelerated for the second month in a row, for the previous four months, the material prices index has been higher than any time since February 2015. Prices received contracted at a minimal rate in August. This was the highest level for the index since prices received were unchanged in February. But, future business expectations declined for the second straight month, as the index fell to its lowest level since February.

Pumps/valves/plumbing products and medical were showing some growth, while aerospace was virtually flat for the second month in a row. Job shops continued to contract as they have since last June. However, in August, the job shops index reached its highest level since March.

Future capital spending plans climbed to more than $500,000 per plant for the first time since November 2015. In August, future capital spending plans reached their highest level since May 2015. Compared with one year ago, future capital spending plans have increased in three of the previous five months. In the previous two months they have increased more than 16 percent. While the annual rate of change was still contracting at a significant rate, it has improved since March, indicating that the weakest part of the capital equipment market was near or behind the industry.

.JPG;width=70;height=70;mode=crop)