Reasons You Can’t Predict Firm Metals Pricing this Year

Your customers may demand that you give them firm pricing for raw materials, but here are four reasons that say “It ain’t gonna happen.”

Business Cycle. Business Cycle is currently in a downward phase. What savvy organizations should be doing right now is planning for budget reductions, cross training employees, evaluate vendors for sustainability. Nothing in the business cycle justifies firming up pricing at this time.

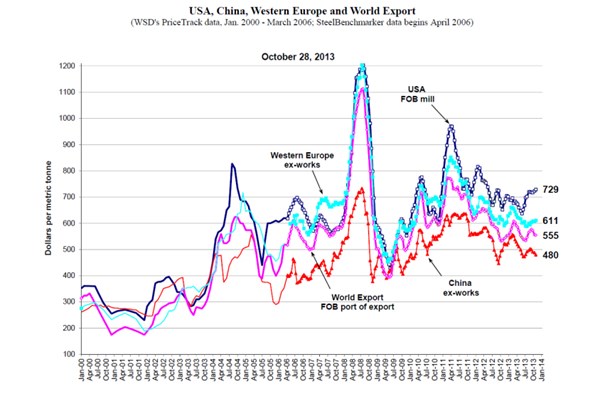

Bias Toward Growth. Everyone expects the prices of things to grow, particularly for commodity raw materials. The Steel Benchmarker chart (above) for hot rolled steel band shows this is hardly ever the case.

Volatility. The Steel Benchmarker chart shows a price differential ranging from 4.5 percent in 2012 to a high of 100 percent in 2008. This is why your customers want firm prices, not why you should bet your business on giving them firm prices over which you have no control.

Determinants of Demand. What is driving demand for the raw materials? Is it even North American or is it China or emerging economies? Global demand is typically what is driving prices here in U.S. and around the globe. U.S. GDP growth in 2013 was estimated to be 1.6 percent of China’s 7.5 percent. Pick a number. Any number.

Customer’s seek firm prices to eliminate their risk, but shoving risk onto suppliers unilaterally is not eliminating risk, it is just getting it off their desk and onto yours. Our job as sustainable, competitive, quality suppliers is to intelligently manage risk. In today’s raw material environment, saying “No!” to agreeing to hold firm prices for raw materials when you have no ability to effect that price’s firming is intelligent management of risk.

Originally posted on PMPAspeakingofprecision.com blog.