Economic Outlook Positive for Medical, Defense Industries

Appears in Print as: 'Positive Economic Outlook for Defense, Medical Industries'

This economic outlook from ITR Economics includes predictions of how well certain manufacturing sectors will do in the foreseeable future, as well as advice on making investments and using low interest rates to your advantage.

#columns

Edited by Lori Beckman

According to Alex Chausovsky with ITR Economics, any companies that are dealing with military and defense technology exporting will experience a promising business outlook in upcoming months/years.

While attending a U.S. economic outlook presentation at the PMPA Management Update Conference in early March (prior to the effects of the coronavirus outbreak), Production Machining heard an economist from ITR Economics predict an economic downturn in 2022-23. Since then, the country has witnessed the pandemic negatively affect the economy. Because of that, PM was interested in getting an update from the company regarding how COVID-19 has affected its outlook as well as posing other questions concerning promising industry sectors and manufacturing investment strategies. Alex Chausovsky, director of speaking services at ITR Economics, graciously accepted an interview with us. Here are his insights.

PM: What is the economic outlook for the near future?

AC: As a result of the events of the last six months, we have revised our outlook. Based on what has been happening, we have severely lowered our expectations for the performance of both manufacturing and the overall economy. As a result of that, a lot of the pressures and flaws that we were expecting to manifest themselves in a more severe contraction in the 2022-23 time frame are being addressed right now. So, the pain we are feeling today will alleviate much of the downturn that we were going to see in 2022-23. We are no longer projecting a recession during that time, but instead a slowdown.

PM: Which end markets will rebound faster than others?

AC: At the top of my list is medical, especially for PPE, and defense. And, as online retail is picking up momentum, packaging, especially warehouse automation, is doing well.

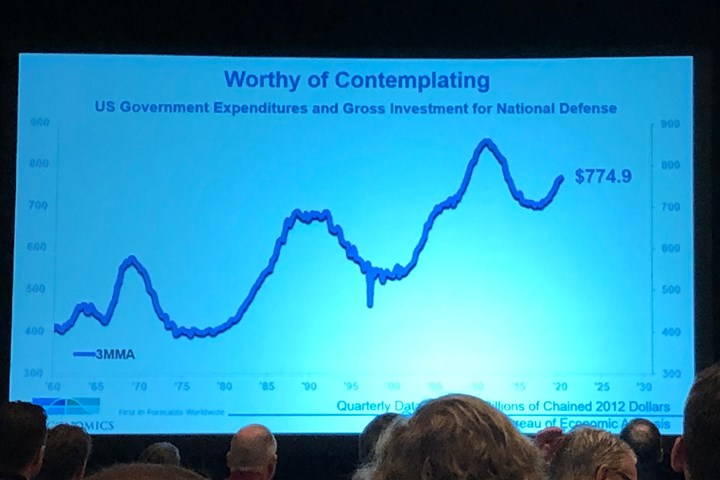

The defense sector is driven by budgeting at the congressional and appropriations committee levels, and funds are assigned years in advance. That is not disrupted by black swan events such as COVID-19.

Anything related to defense exports will stay healthy. Moving forward, the government is going to look at possible ways to rein in U.S. spending. It’s certainly feasible that domestic defense spending will come under scrutiny as well. Any companies that are dealing with military and defense technology exporting will be looking at increased demand. Foreign governments are looking to U.S. defense manufacturing and contractors for products because they know we have the highest grade military technology available. For example, unmanned aerial vehicles and unmanned combat vehicles are very hot right now. Any manufacturing related to that demand should remain robust.

The general manufacturing sector will struggle to come back from this downturn in a short time. In fact, we are not expecting a return to normal levels of activity until 2023.

PM: Is now a good time to invest in capital equipment?

AC: I think, in general, it’s prudent to look for opportunities to invest during periods of decline. We are expecting the low point in the cycle — the worst of it — to come in early 2021. With that, we will see lower prices during that time. As the cost of your investments continue to pull back, you certainly want to take advantage of that to position your business to take advantage of the next rising trend starting in the middle of next year.

Look for investment opportunities such as acquisition targets and talent — not just capital equipment. But right now, it is too early to invest. Your focus should be on cash flow management – making sure you have the bridge to get past the weak demand. Early next year will be a good time for investments, but now is when you should be doing your research.

PM: Do you expect interest rates to increase soon?

AC: We do not expect any meaningful upward momentum in interest rates to occur soon. Right now, the government’s focus is maintaining liquidity and providing capital at a low cost for businesses to get through this difficult period. It is highly unlikely that there will be any increases this year and likely not until the economy gains some traction. Keep in mind that interest rate policy is usually used to keep inflation under control. Right now, there is not a reason for the government to raise rates because, if they do, they will also be paying a higher price for the massive national debt. Businesses should be leveraging the favorable lending environment of the next 12 to 18 months because the cost of doing so is very advantageous.

About the Author

Alex Chausovsky

A highly experienced market researcher and analyst, Chausovsky has more than a decade of expertise in macroeconomics, industrial manufacturing, automation and advanced technology trends. Contact: 603-796-2500, itr@itreconomics.com.

RELATED CONTENT

-

Manufacturing Knowledge is Power

The Knowledge Centers with video produced by brands such as Production Machining on the IMTS spark online platform take deep dives into technology and trends related to various CNC machining and manufacturing topics.

-

Is the German Apprenticeship Model the Answer for U.S. Manufacturing?

This machine tool builder president and CEO is an ardent proponent of the German apprenticeship model and believes this concept could be applied here in the United States to address the skilled labor shortage.

-

Good Bonding and Coating with Contact Angle Measurements

Darren Williams answers common questions about using a contact angle measurement to determine part cleanliness. Using water to test cleanliness reveals the effectiveness of a cleaning process.